- Best Savings Accounts in Singapore to Park Your Money (2023)

- Why Savings Accounts are Important

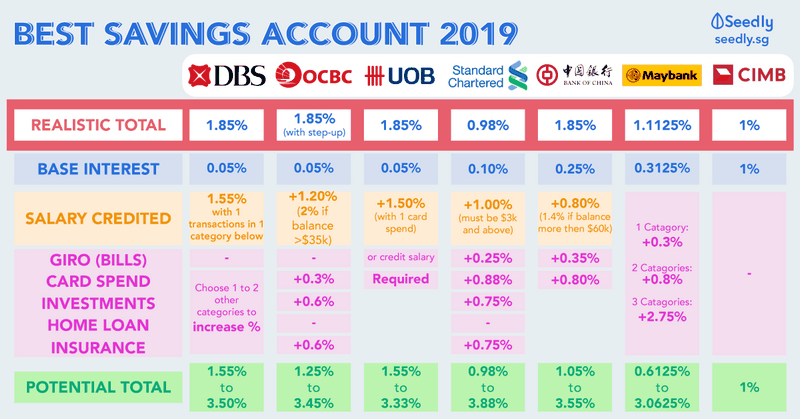

- Choosing the Right Savings Account

- Bank A Savings Account

- Bank B Savings Account

- Bank C Savings Account

- Bank D Savings Account

- Bank E Savings Account

- Bank F Savings Account

- Bank G Savings Account

- Bank H Savings Account

- Bank I Savings Account

- Bank J Savings Account

- FAQ:

- What are the top 10 savings accounts in Singapore for 2023?

- Which is the best savings account in Singapore for 2023?

Best Savings Accounts in Singapore to Park Your Money (2023)

Looking for the best savings accounts in Singapore to park your money in 2023? We’ve got you covered! Whether you’re saving up for a dream vacation or planning for your future, finding the right savings account can make a big difference. Here are the top 10 savings accounts in Singapore that you should consider:

- DBS Multiplier Account: Earn higher interest rates by performing multiple banking activities.

- OCBC 360 Account: Enjoy attractive interest rates and cashback rewards.

- UOB One Account: Get up to 3.88% p.a. interest and bonus interest on your savings.

- Citibank MaxiGain Account: Earn higher interest rates as your savings grow.

- Standard Chartered Bonus$aver Account: Enjoy bonus interest rates and cashback on your spending.

- MAYBANK Save Up Programme: Earn higher interest rates and cash rebates on your daily expenses.

- HSBC Everyday Global Account: Enjoy competitive interest rates and access to a wide range of currencies.

- POSB SAYE Account: Save regularly and earn bonus interest on your savings.

- CIMB FastSaver Account: Enjoy high interest rates and easy access to your savings.

- SCB JumpStart Account: Start saving with as little as $1 and enjoy competitive interest rates.

With these top 10 savings accounts in Singapore, you can make the most of your money in 2023 and achieve your financial goals. Start saving today!

Why Savings Accounts are Important

In today’s fast-paced world, it is more important than ever to have a savings account. Savings accounts provide a safe and secure place to park your money, ensuring that it is protected and easily accessible when you need it. In Singapore, where the cost of living is high and the economy is constantly evolving, having a savings account is crucial to financial stability.

Savings accounts offer a range of benefits that make them an attractive option for individuals looking to save for the future. One of the key advantages of a savings account is the ability to earn interest on your deposited funds. This means that your money can grow over time, helping you to achieve your financial goals faster.

Furthermore, savings accounts in Singapore often come with additional perks and features. Some accounts offer cashback rewards or bonus interest rates for meeting certain criteria, such as maintaining a minimum balance or making regular deposits. These incentives can help you maximize your savings and make the most of your money in 2023.

Another important aspect of savings accounts is their flexibility. Unlike other investment options, such as fixed deposits or stocks, savings accounts allow you to easily access your funds whenever you need them. This makes them ideal for emergency situations or unexpected expenses.

In conclusion, savings accounts are a vital tool in managing your finances and securing your future. They provide a safe haven for your money, offer the potential for growth through interest, and come with added benefits and flexibility. Start exploring the top savings accounts in Singapore for 2023 and take control of your financial well-being.

Choosing the Right Savings Account

When it comes to managing your money in 2023, finding the best savings account is crucial. In Singapore, there are a variety of options available to help you grow your savings and meet your financial goals. Whether you’re saving for a down payment on a house, planning for retirement, or simply looking to build an emergency fund, choosing the right savings account can make a significant difference.

One of the top considerations when selecting a savings account is the interest rate. The higher the interest rate, the more your money will grow over time. Look for accounts that offer competitive rates and consider whether the interest is compounded daily, monthly, or annually to maximize your savings potential.

Another factor to consider is the convenience and accessibility of the account. Look for accounts that offer online banking, mobile app access, and ATM networks that are convenient for you. This will make it easier to track your savings, make deposits and withdrawals, and manage your account from anywhere.

In addition to interest rates and convenience, it’s important to consider any fees associated with the account. Some savings accounts may have monthly maintenance fees or minimum balance requirements. Be sure to read the fine print and choose an account that aligns with your financial situation and goals.

Lastly, consider the reputation and stability of the bank or financial institution offering the savings account. Look for a bank with a strong track record and positive customer reviews. This will give you peace of mind knowing that your money is safe and secure.

In conclusion, choosing the right savings account in Singapore for 2023 requires careful consideration of interest rates, convenience, fees, and the reputation of the bank. By doing your research and selecting an account that meets your needs, you can make the most of your savings and achieve your financial goals.

Bank A Savings Account

Are you looking for the best savings account to park your money in Singapore in 2023? Look no further than Bank A Savings Account. With its competitive interest rates and reliable service, Bank A Savings Account is the top choice for savvy savers.

Bank A offers a range of savings accounts to suit your individual needs. Whether you’re a student, a working professional, or a retiree, Bank A has the perfect account for you. With options like high-yield savings accounts and flexible withdrawal options, you can easily grow your savings while still having access to your funds when you need them.

One of the standout features of Bank A Savings Account is its user-friendly online banking platform. With just a few clicks, you can check your balance, transfer funds, and set up automatic savings plans. This convenience makes it easier than ever to stay on top of your finances and reach your savings goals.

In addition to its excellent features, Bank A Savings Account is backed by a solid reputation in the banking industry. With a long history of providing reliable and secure banking services, you can trust that your money is in good hands with Bank A. Plus, with its extensive network of ATMs and branches across Singapore, accessing your funds has never been easier.

Don’t miss out on the opportunity to make the most of your savings in 2023. Choose Bank A Savings Account for the best savings experience in Singapore. Start saving today and watch your money grow.

Bank B Savings Account

Looking for the best savings account in Singapore for 2023? Consider Bank B Savings Account. With its competitive interest rates and flexible features, it is a great choice for anyone looking to park their money and watch it grow.

Bank B Savings Account offers one of the highest interest rates in the market, allowing you to maximize your savings. Whether you are saving for a rainy day, a dream vacation, or a future investment, this account can help you achieve your financial goals.

What sets Bank B Savings Account apart from the rest is its convenience. You can easily manage your account online, making it hassle-free to track your savings and make transactions. With just a few clicks, you can transfer funds, set up automatic savings plans, and monitor your account activity.

Moreover, Bank B Savings Account provides a range of additional benefits to its customers. From exclusive discounts and promotions to access to financial planning services, you can enjoy a holistic banking experience. The bank also offers personalized customer support, ensuring that your needs are met every step of the way.

Don’t miss out on the opportunity to grow your savings in 2023. Choose Bank B Savings Account and take control of your financial future. Visit any Bank B branch or their website to open an account today!

Bank C Savings Account

If you are looking for the best savings accounts in Singapore, look no further than Bank C Savings Account. With its competitive interest rates and flexible features, it is the perfect choice for anyone who wants to park their money and watch it grow.

At Bank C, we understand the importance of saving money and we want to help you achieve your financial goals. Our savings account offers a high interest rate, allowing you to maximize your savings and earn more money in the long run.

With Bank C Savings Account, you can easily manage your funds and track your savings progress. Our user-friendly online banking platform allows you to check your balance, make transfers, and set up automatic savings plans. You can also access your account through our mobile app, making it convenient to save money on the go.

In addition to our competitive interest rates and convenient banking features, Bank C Savings Account also offers various benefits and rewards. From cashback promotions to exclusive discounts, we want to reward you for choosing us as your savings partner.

Don’t miss out on the opportunity to grow your savings with Bank C Savings Account. Start saving today and enjoy the benefits of one of the best savings accounts in Singapore.

Bank D Savings Account

Looking for the best savings account in Singapore for 2023? Look no further than Bank D Savings Account. With its competitive interest rates and convenient features, it is the perfect choice for individuals who want to grow their savings.

Bank D Savings Account offers a variety of benefits that set it apart from other accounts. First, it offers one of the highest interest rates in the market, allowing you to maximize your savings. Whether you are saving for a dream vacation or a down payment on a new home, Bank D Savings Account can help you reach your financial goals.

In addition to its attractive interest rates, Bank D Savings Account also provides easy access to your funds. With online and mobile banking, you can conveniently manage your account anytime, anywhere. Say goodbye to long queues at the bank and hello to hassle-free banking.

Furthermore, Bank D Savings Account offers a wide network of ATMs and branches, making it convenient for you to withdraw cash or make transactions. Whether you are in the heart of the city or enjoying a day at the park, you can easily access your funds.

Don’t miss out on the opportunity to open a Bank D Savings Account in 2023. Start saving for your future today and enjoy the benefits of one of the best savings accounts in Singapore.

Bank E Savings Account

Looking for the best savings account in Singapore for 2023? Look no further than Bank E Savings Account! With its competitive interest rates and flexible terms, it is the perfect choice for anyone looking to grow their savings.

Bank E Savings Account offers a wide range of features and benefits to help you make the most of your money. Whether you are saving for a down payment on a house, planning for retirement, or simply looking to build an emergency fund, this account has got you covered.

One of the standout features of Bank E Savings Account is its convenient online banking platform. You can easily access and manage your account from anywhere, whether you are at home, at work, or on the go. This means you can park your money in this account and watch it grow without any hassle.

With Bank E Savings Account, you can also enjoy peace of mind knowing that your money is in safe hands. The bank has a strong reputation for its financial stability and customer service, making it a trusted choice for many Singaporeans.

So why wait? Open a Bank E Savings Account today and start maximizing your savings in 2023!

Bank F Savings Account

Looking for the best savings account in Singapore for 2023? Look no further than Bank F Savings Account. With Bank F, you can save money with confidence and peace of mind.

Bank F Savings Account offers competitive interest rates that will help your savings grow faster. Whether you are saving for a rainy day, a dream vacation, or a down payment on a new home, Bank F has got you covered.

What sets Bank F Savings Account apart from the rest is its flexibility. You can access your funds anytime, anywhere, making it convenient for your busy lifestyle. Plus, there are no monthly fees or minimum balance requirements, so you can save without any hassle.

Bank F is committed to providing excellent customer service. Their team of dedicated professionals is always ready to assist you with any questions or concerns you may have. You can trust Bank F to take care of your savings and help you achieve your financial goals.

Don’t miss out on the opportunity to save smart in 2023. Choose Bank F Savings Account and start building your financial future today!

Bank G Savings Account

Looking for the best savings account in Singapore for 2023? Look no further than Bank G Savings Account. With its competitive interest rates and convenient features, it is the perfect choice for individuals looking to grow their savings.

Located in the heart of Singapore, Bank G offers a wide range of savings accounts to suit your financial needs. Whether you are saving for a down payment on a new home or planning for your retirement, Bank G has the perfect account for you.

With Bank G Savings Account, you can easily manage your money and track your savings goals. The account comes with a user-friendly online banking platform, allowing you to access your account anytime, anywhere. You can also set up automatic transfers to ensure that you are consistently saving towards your goals.

Bank G takes the security of your funds seriously. They offer robust security measures to protect your account from unauthorized access. You can rest easy knowing that your hard-earned money is safe with Bank G.

Don’t miss out on the opportunity to grow your savings in 2023. Open a Bank G Savings Account today and start saving for a brighter future.

Bank H Savings Account

Looking for a reliable savings account to park your money in Singapore in 2023? Look no further than Bank H Savings Account. With its competitive interest rates and flexible features, this account is designed to help you grow your savings effortlessly.

Bank H Savings Account offers a range of benefits that make it the perfect choice for your financial goals. With its high interest rate, you can maximize your savings and watch your money grow over time. Plus, with no minimum balance requirement, you can start saving with any amount you have.

What sets Bank H Savings Account apart from other accounts is its convenience. With online banking and mobile app access, you can manage your savings anytime, anywhere. Whether you want to check your balance, make transfers, or track your transactions, everything is just a few clicks away.

Bank H Savings Account also offers additional perks such as free e-statements and SMS alerts to keep you updated on your savings journey. You can also set up automatic transfers to make saving even easier. With these features, you can stay on top of your finances and achieve your savings goals faster.

Don’t miss out on the opportunity to grow your savings with Bank H Savings Account. Start saving for a brighter future today!

Bank I Savings Account

Looking for the best savings account in Singapore for 2023? Look no further than Bank I Savings Account. With Bank I, you can park your money in a secure and reliable savings account that offers competitive interest rates.

Why choose Bank I Savings Account? Firstly, Bank I is known for its strong reputation and stability in the banking industry. Your hard-earned savings will be in safe hands, giving you peace of mind.

Secondly, Bank I Savings Account offers attractive interest rates, allowing you to grow your savings faster. Whether you’re saving for a dream vacation, a down payment on a house, or your child’s education, Bank I can help you reach your financial goals.

Bank I also offers a range of convenient features to make managing your savings easier. With online banking and mobile app access, you can check your account balance, transfer funds, and set up automatic savings plans anytime, anywhere.

Additionally, Bank I provides excellent customer service. Their friendly and knowledgeable staff are always ready to assist you with any questions or concerns you may have about your savings account.

In conclusion, Bank I Savings Account is the top choice for savers in Singapore in 2023. With its strong reputation, competitive interest rates, convenient features, and excellent customer service, Bank I is the best option for growing your savings and achieving your financial goals.

Bank J Savings Account

Looking for the best savings account in Singapore for 2023? Look no further than Bank J Savings Account. With its competitive interest rates and convenient features, it’s the perfect choice for park your money and watch it grow.

Bank J Savings Account offers one of the highest interest rates in Singapore, allowing you to maximize your savings. Whether you’re saving for a rainy day or a specific goal, this account will help you reach your financial targets faster.

With Bank J Savings Account, you can easily manage your money online or through their mobile app. You can track your savings, set up automatic transfers, and even receive personalized financial advice to make the most of your money.

What sets Bank J Savings Account apart from other accounts is its flexibility. You can deposit and withdraw money anytime without penalties, giving you the freedom to access your funds whenever you need them. Additionally, you can choose from various account types, such as individual or joint accounts, to suit your specific needs.

Don’t miss out on the opportunity to grow your savings in 2023. Open a Bank J Savings Account today and start making the most of your money.

FAQ:

What are the top 10 savings accounts in Singapore for 2023?

The top 10 savings accounts in Singapore for 2023 are: 1. DBS Multiplier Account 2. OCBC 360 Account 3. UOB One Account 4. Standard Chartered Bonus$aver Account 5. Maybank SaveUp Account 6. CIMB FastSaver Account 7. Citibank InterestPlus Savings Account 8. HSBC Everyday Global Account 9. RHB High-Yield Savings Account 10. BOC SmartSaver Account

Which is the best savings account in Singapore for 2023?

The best savings account in Singapore for 2023 depends on your individual needs and preferences. However, some popular options include the DBS Multiplier Account, OCBC 360 Account, and UOB One Account. These accounts offer competitive interest rates and various perks such as cashback and rewards. It’s recommended to compare the features and benefits of different accounts before making a decision.