- Everything you need to know about loan-to-value limits and the best home loans in Singapore.

- Understanding Loan-to-Value Limits

- What are Loan-to-Value Limits?

- Why are Loan-to-Value Limits Important?

- How do Loan-to-Value Limits Work?

- Factors that Affect Loan-to-Value Limits

- Benefits of High Loan-to-Value Limits

- Drawbacks of High Loan-to-Value Limits

- How to Calculate Loan-to-Value Ratio

- Loan-to-Value Limits in Singapore

- Loan-to-Value Limits for First-Time Home Buyers

- Loan-to-Value Limits for Second-Time Home Buyers

- Loan-to-Value Limits for HDB Flats

- Loan-to-Value Limits for Private Properties

- Loan-to-Value Limits for Executive Condominiums

- How to Find the Best Home Loans in Singapore

- Factors to Consider when Choosing a Home Loan

- Comparison of Home Loan Options

Everything you need to know about loan-to-value limits and the best home loans in Singapore.

When it comes to purchasing a home in Singapore, loans play a crucial role in making this dream a reality. However, before diving into the world of home loans, it is important to understand loan-to-value limits and how they can affect your borrowing capacity.

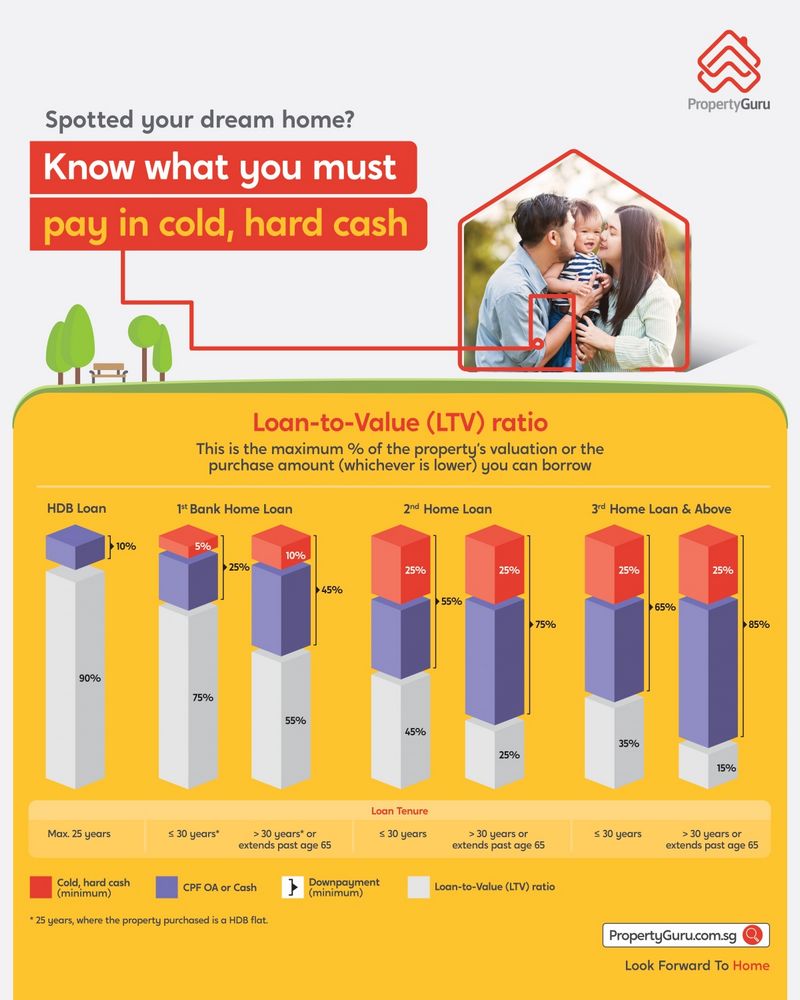

Loan-to-value (LTV) limits refer to the maximum amount of money a lender is willing to lend you based on the value of the property you wish to purchase. These limits are set by the Monetary Authority of Singapore (MAS) and are designed to ensure financial stability and prevent excessive borrowing. It is important to note that LTV limits may vary depending on factors such as the type of property, the loan tenure, and the borrower’s creditworthiness.

When searching for the best home loans in Singapore, it is crucial to consider the LTV limits imposed by the MAS. These limits can impact the amount of down payment you need to make and the loan amount you can borrow. By understanding the LTV limits, you can better assess your financial situation and determine the best loan option for your needs.

Additionally, finding the best home loan requires careful consideration of other factors such as interest rates, loan tenure, and repayment options. It is advisable to compare different loan packages offered by various banks and financial institutions to find the one that suits your financial goals and preferences. Seeking professional advice from mortgage brokers or financial advisors can also be beneficial in navigating the complex world of home loans.

In conclusion, understanding loan-to-value limits is essential when searching for the best home loans in Singapore. By familiarizing yourself with these limits and considering other important factors, you can make an informed decision and secure the loan that best fits your needs and financial situation.

Understanding Loan-to-Value Limits

When it comes to buying a home in Singapore, understanding loan-to-value limits is essential. Loan-to-value (LTV) limits refer to the maximum amount of money a lender is willing to lend you based on the value of the property you wish to purchase. These limits are set by the Monetary Authority of Singapore (MAS) and are designed to mitigate the risks associated with home loans.

Knowing the loan-to-value limits can help you determine the best home loan options available to you. The higher the LTV limit, the less money you will need to put down as a down payment. On the other hand, if the LTV limit is low, you will need to have a larger down payment to secure a loan.

In Singapore, the loan-to-value limits vary depending on various factors, such as the type of property, the loan tenure, and whether you are a first-time buyer or an existing homeowner. For example, if you are buying your first home, you may be eligible for a higher LTV limit compared to someone who already owns a property.

It is important to note that even if you meet the loan-to-value limits, lenders will still assess your financial situation and creditworthiness before approving your loan. They will consider factors such as your income, employment stability, and credit score to determine the risk of lending you money.

To find the best home loans in Singapore, it is crucial to understand the loan-to-value limits and how they may affect your borrowing capacity. By comparing different loan options and considering your financial situation, you can make an informed decision and find a loan that suits your needs and budget.

What are Loan-to-Value Limits?

Loan-to-Value (LTV) limits are an important factor to consider when applying for a home loan in Singapore. These limits determine the maximum amount of financing you can get based on the value of the property you wish to purchase. LTV limits are set by the Monetary Authority of Singapore (MAS) and are in place to ensure responsible lending practices and to mitigate the risk of borrowers defaulting on their loans.

For example, if the LTV limit is set at 80%, it means that you can borrow up to 80% of the property’s value, and you will need to provide the remaining 20% as a down payment. The LTV limit may vary depending on factors such as the type of property, the loan tenure, and the borrower’s financial profile.

Understanding LTV limits is crucial when looking for the best home loans in Singapore. Different lenders may have different LTV limits, so it’s important to compare loan options and find the one that offers the best terms and conditions for your specific situation. Keep in mind that a higher LTV limit may allow you to borrow more, but it also means taking on more debt and potentially higher interest rates.

It’s also worth noting that LTV limits can change over time, depending on market conditions and regulatory policies. Therefore, it’s important to stay informed and regularly review your loan options to ensure you are getting the best deal possible.

Why are Loan-to-Value Limits Important?

The loan-to-value (LTV) limits play a crucial role in the home loan market in Singapore. These limits determine the maximum amount of money that lenders are willing to lend to borrowers in relation to the appraised value of the property. Understanding these limits is essential for borrowers looking to secure the best home loans in Singapore.

Loan-to-value limits are important because they help mitigate the risk for lenders. By setting a limit on the amount of money they are willing to lend, lenders can ensure that they are protected in case the borrower defaults on the loan. These limits also help to prevent borrowers from taking on too much debt and becoming financially overburdened.

Additionally, loan-to-value limits can have an impact on the interest rates offered by lenders. Generally, borrowers with a lower loan-to-value ratio are considered less risky and may be eligible for lower interest rates. On the other hand, borrowers with a higher loan-to-value ratio may face higher interest rates or may even be denied a loan altogether.

It is important for borrowers to be aware of the loan-to-value limits set by lenders as it can affect their ability to secure financing for their dream home. By understanding these limits and working towards a lower loan-to-value ratio, borrowers can increase their chances of getting approved for the best home loans in Singapore at favorable interest rates.

How do Loan-to-Value Limits Work?

When it comes to home loans in Singapore, loan-to-value (LTV) limits play a crucial role in determining the amount of money a borrower can borrow to finance their property purchase. LTV limits are set by the Monetary Authority of Singapore (MAS) and are designed to regulate the amount of risk that banks and financial institutions can take on when lending money for home loans.

The loan-to-value ratio is calculated by dividing the loan amount by the appraised value of the property. For example, if a borrower wants to purchase a property valued at $1 million and the LTV limit is set at 80%, the maximum loan amount they can borrow is $800,000. This means the borrower would need to come up with a down payment of $200,000 or 20% of the property’s value.

It’s important to note that LTV limits can vary depending on the type of property being purchased. For example, the LTV limit for a HDB flat is typically higher than for private residential properties. This is because HDB flats are considered to be a lower-risk asset and are subject to certain eligibility criteria set by the government.

Additionally, LTV limits can also be affected by factors such as the borrower’s creditworthiness, income level, and the loan tenure. Banks and financial institutions may impose stricter LTV limits for borrowers with higher credit risks or for longer loan tenures.

Understanding loan-to-value limits is essential for borrowers looking to secure the best home loan in Singapore. By knowing the maximum loan amount they can borrow based on the LTV limit, borrowers can better plan their finances and ensure they have enough funds for the down payment and other associated costs of purchasing a property.

Factors that Affect Loan-to-Value Limits

When it comes to getting loans for a home in Singapore, loan-to-value limits are an important factor to consider. These limits determine how much money you can borrow based on the value of the property you want to purchase. Several factors affect these loan-to-value limits, and understanding them can help you find the best home loans in Singapore.

1. Property Type: The type of property you want to buy can impact the loan-to-value limit. Generally, banks are more willing to lend a higher percentage of the property value for private properties compared to HDB flats.

2. Loan Tenure: The length of the loan tenure can also influence the loan-to-value limit. Banks may be more conservative with higher loan-to-value limits for longer loan tenures, as it increases the risk for the lender.

3. Borrower’s Creditworthiness: Your creditworthiness plays a crucial role in determining the loan-to-value limit. Banks will assess your credit score, income stability, and debt-to-income ratio to determine your ability to repay the loan. A strong credit profile can result in a higher loan-to-value limit.

4. Loan Amount: The loan amount you are requesting can impact the loan-to-value limit. Banks may be more conservative with higher loan-to-value limits for larger loan amounts, as it increases the risk for the lender.

5. Market Conditions: Market conditions can also influence loan-to-value limits. During periods of economic uncertainty or housing market volatility, banks may tighten their lending criteria and reduce the loan-to-value limits to mitigate risk.

Considering these factors and understanding how they affect loan-to-value limits can help you make informed decisions when searching for the best home loans in Singapore. It is important to compare loan offers from different banks and work with a mortgage broker to find the most suitable loan option for your needs.

Benefits of High Loan-to-Value Limits

When it comes to obtaining loans for purchasing a home in Singapore, the loan-to-value limits play a crucial role. These limits determine the maximum amount of financing a borrower can receive based on the value of the property. High loan-to-value limits offer several benefits for homebuyers.

One of the main benefits of high loan-to-value limits is that they allow borrowers to finance a larger portion of the property’s purchase price. This means that homebuyers don’t have to worry about coming up with a large down payment upfront, making homeownership more accessible and affordable.

Furthermore, high loan-to-value limits provide borrowers with greater flexibility in their financing options. With more financing available, homebuyers have the opportunity to choose from a wider range of loan products and lenders. This enables them to find the best home loan in Singapore that suits their specific needs and preferences.

In addition, high loan-to-value limits can also help stimulate the housing market. By allowing borrowers to access more financing, these limits encourage more people to enter the market and purchase homes. This increased demand can lead to a healthier housing market with more activity and growth.

Overall, high loan-to-value limits offer numerous advantages for homebuyers in Singapore. They make homeownership more attainable, provide greater financing options, and contribute to a thriving housing market. It is important for borrowers to understand these limits and work with reputable lenders to find the best home loan that fits their financial situation.

Drawbacks of High Loan-to-Value Limits

While high loan-to-value limits may seem attractive to homebuyers, there are several drawbacks to consider.

1. Increased Risk: When borrowers take out a loan with a high loan-to-value ratio, they are borrowing a larger percentage of the home’s value. This means that if property values decline, they may end up owing more on their mortgage than the home is worth. This increases the risk of negative equity, making it difficult to sell or refinance the property in the future.

2. Higher Interest Rates: Lenders often charge higher interest rates for loans with high loan-to-value ratios. This is because they are taking on more risk by lending a larger amount compared to the value of the home. As a result, borrowers may end up paying more in interest over the life of the loan.

3. Limited Financing Options: High loan-to-value limits may limit the financing options available to borrowers. Some lenders may require additional mortgage insurance or higher down payments to mitigate the risk associated with these loans. This can make it more challenging for borrowers to find the best home loan options in Singapore.

4. Reduced Flexibility: Borrowers with high loan-to-value loans may have less flexibility in managing their finances. With a larger loan amount, they may have higher monthly mortgage payments, leaving less room for other expenses or savings. This can impact their financial stability and limit their ability to adapt to unexpected changes in their circumstances.

5. Potential for Negative Equity: If property values decline, borrowers with high loan-to-value loans may find themselves in a situation of negative equity. This means that they owe more on their mortgage than the home is worth. Negative equity can make it challenging to sell the property or refinance the loan, trapping borrowers in a financially burdensome situation.

Overall, while high loan-to-value limits may offer more flexibility in terms of financing options, borrowers should carefully consider the potential drawbacks before committing to a loan. It is important to assess their own financial situation, risk tolerance, and long-term goals to determine the best home loan options in Singapore.

How to Calculate Loan-to-Value Ratio

Calculating the loan-to-value (LTV) ratio is an important step in understanding the limits and options for home loans in Singapore. The LTV ratio is a percentage that represents the amount of the loan compared to the value of the home. It is calculated by dividing the loan amount by the appraised value of the property.

To calculate the LTV ratio, you need to know the loan amount and the appraised value of the home. The loan amount is the total amount of money that you are borrowing from the bank or financial institution. The appraised value of the home is determined by a professional appraiser who assesses the value based on various factors such as location, size, condition, and comparable sales in the area.

Once you have the loan amount and the appraised value of the home, you can calculate the LTV ratio by dividing the loan amount by the appraised value and multiplying by 100 to get the percentage. For example, if the loan amount is $300,000 and the appraised value of the home is $500,000, the LTV ratio would be calculated as follows:

- Loan amount: $300,000

- Appraised value: $500,000

- LTV ratio: ($300,000 / $500,000) * 100 = 60%

The LTV ratio is an important factor for lenders when determining the risk of a loan. Higher LTV ratios indicate a higher risk for the lender, as the borrower has less equity in the property. In Singapore, there are limits on the maximum LTV ratio for different types of loans and properties. These limits are set by the Monetary Authority of Singapore (MAS) and are designed to ensure financial stability and protect borrowers.

Understanding how to calculate the LTV ratio is crucial when searching for the best home loans in Singapore. By knowing the LTV ratio, you can determine the amount of down payment required and the loan options available to you. It is important to compare different loan options and consider factors such as interest rates, repayment terms, and fees to find the best loan that suits your needs and financial situation.

Loan-to-Value Limits in Singapore

When it comes to purchasing a home in Singapore, understanding loan-to-value limits is crucial. These limits determine the maximum amount of financing a borrower can obtain based on the value of the property. The Monetary Authority of Singapore (MAS) sets these limits to ensure financial stability and to prevent excessive borrowing.

For example, if the loan-to-value limit is set at 80%, it means that borrowers can finance up to 80% of the home’s value, while the remaining 20% must be paid in cash or through other means. These limits vary depending on the type of property and the borrower’s financial situation.

It is important to note that the loan-to-value limits may change over time, depending on market conditions and government regulations. Therefore, it is essential for borrowers to stay updated with the latest information to make informed decisions about their home loans.

When looking for the best home loans in Singapore, borrowers should consider not only the loan-to-value limits but also other factors such as interest rates, repayment terms, and fees. Comparing different loan options from various lenders can help borrowers find the most suitable loan for their needs.

Overall, understanding loan-to-value limits and considering other factors when searching for home loans in Singapore is essential. It allows borrowers to make informed decisions and find the best financing options for their dream homes.

Loan-to-Value Limits for First-Time Home Buyers

When it comes to purchasing a home in Singapore, first-time home buyers need to be aware of the loan-to-value limits set by the government. These limits determine how much they can borrow from financial institutions to finance their property purchase. Understanding these limits is crucial for first-time home buyers to make informed decisions and find the best home loans.

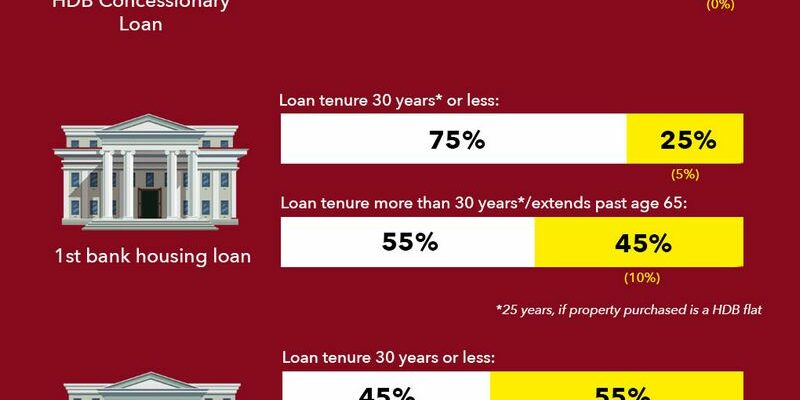

In Singapore, the loan-to-value limits for first-time home buyers vary depending on the type of property they are purchasing. For example, for HDB flats, the loan-to-value limit is 90% for the first loan and 80% for the second loan. On the other hand, for private residential properties, the loan-to-value limit is 75% for the first loan and 45% for the second loan.

These limits are in place to ensure that first-time home buyers do not overextend themselves financially and to prevent excessive speculation in the property market. By limiting the amount of money that can be borrowed, the government aims to promote a stable and sustainable housing market in Singapore.

First-time home buyers should also be aware that the loan-to-value limits may change over time, depending on market conditions and government policies. It is important to stay updated on any changes to these limits to ensure that they are able to secure the best home loans available to them.

In conclusion, understanding loan-to-value limits is crucial for first-time home buyers in Singapore. By knowing these limits, they can make informed decisions and find the best home loans that suit their financial situation. It is important to stay updated on any changes to these limits to ensure that they are able to make the most of the opportunities available in the housing market.

Loan-to-Value Limits for Second-Time Home Buyers

When it comes to buying a second home in Singapore, understanding loan-to-value (LTV) limits is crucial. LTV limits determine the maximum loan amount that a borrower can obtain based on the property’s value. For second-time home buyers, these limits may differ from those for first-time buyers.

For second-time home buyers in Singapore, the loan-to-value limits are typically lower than those for first-time buyers. This is because second-time buyers are considered to have more experience in the property market and are expected to have a higher level of financial stability. The lower LTV limits help to mitigate the risks associated with borrowing for a second property.

It is important for second-time home buyers to consider these loan-to-value limits when searching for the best home loans in Singapore. By understanding the maximum loan amount they can obtain, buyers can better assess their financial capabilities and make informed decisions about their property purchase.

Additionally, second-time home buyers may need to provide additional documentation and meet stricter eligibility criteria in order to qualify for a loan. Lenders may require proof of income, credit history, and existing property ownership. It is advisable for buyers to gather all necessary documents and information before applying for a loan.

In summary, loan-to-value limits for second-time home buyers in Singapore are typically lower than those for first-time buyers. Understanding these limits and meeting the necessary eligibility criteria is essential when searching for the best home loans in Singapore.

Loan-to-Value Limits for HDB Flats

When it comes to getting loans for HDB flats in Singapore, it’s important to understand the loan-to-value limits that are in place. These limits determine how much money you can borrow based on the value of the property you are purchasing.

The loan-to-value limits for HDB flats vary depending on whether you are a first-time buyer or a second-time buyer. For first-time buyers, the limit is set at 90% of the purchase price or valuation, whichever is lower. This means that you can borrow up to 90% of the value of the HDB flat.

For second-time buyers, the loan-to-value limit is lower at 75% of the purchase price or valuation, whichever is lower. This means that you can borrow up to 75% of the value of the HDB flat. The lower limit for second-time buyers is in place to prevent excessive borrowing and to ensure that buyers have enough equity in their property.

It’s important to note that these loan-to-value limits apply to both bank loans and HDB loans. If you are taking out a bank loan, you will need to meet the loan-to-value limits set by the bank. If you are taking out an HDB loan, you will need to meet the loan-to-value limits set by HDB.

Understanding the loan-to-value limits for HDB flats is crucial when looking for the best home loans in Singapore. By knowing how much you can borrow based on the value of the property, you can better plan your finances and choose the loan that best suits your needs.

Loan-to-Value Limits for Private Properties

When it comes to home loans in Singapore, understanding the loan-to-value limits is essential. Loan-to-value (LTV) limits determine the maximum amount of money a bank or financial institution is willing to lend you for a private property purchase. These limits are set by the Monetary Authority of Singapore (MAS) and are designed to ensure that borrowers do not take on excessive debt.

The loan-to-value limits for private properties in Singapore vary depending on factors such as the loan tenure, the number of outstanding loans you have, and whether you are a Singapore citizen or a permanent resident. Generally, for first-time homebuyers, the LTV limit is set at 75% for the first loan and 45% for subsequent loans. For non-individual borrowers, such as companies or trusts, the LTV limit is typically lower.

It’s important to note that the loan-to-value limits also apply to refinancing loans. If you are looking to refinance your existing home loan, you will need to meet the LTV limits set by the MAS. This means that if the current value of your property has decreased, you may not be able to refinance the full amount of your outstanding loan.

Before applying for a home loan, it’s crucial to understand the loan-to-value limits that apply to your situation. This will help you determine how much you can borrow and what type of property you can afford. You should also consider factors such as your income, credit score, and financial stability when deciding on the loan amount and property purchase.

Loan-to-Value Limits for Executive Condominiums

The loan-to-value (LTV) limits for executive condominiums (ECs) in Singapore are set by the government to regulate the amount of financing that can be obtained for purchasing such properties. These limits are put in place to ensure that buyers are not overly leveraged and to maintain stability in the housing market.

For first-time buyers, the LTV limit for ECs is set at 75% of the purchase price or valuation, whichever is lower. This means that buyers will need to provide a minimum down payment of 25% of the property’s value. For second-time buyers, the LTV limit is 45% if the EC was bought directly from the developer, and 35% if the EC was bought from the resale market.

It is important to note that the LTV limits for ECs are different from those for private residential properties. This is because ECs are considered a hybrid between public and private housing, and are subject to certain eligibility criteria and restrictions. Therefore, it is crucial for buyers to understand the specific LTV limits for ECs before applying for a home loan.

When considering home loans for ECs, it is essential to take into account the LTV limits and choose a loan package that is suitable for your financial situation. It is advisable to compare different loan options from various banks and financial institutions to find the best deal. Additionally, it is recommended to consult with a mortgage broker or financial advisor who can provide guidance and help you navigate through the loan application process.

In conclusion, understanding the loan-to-value limits for executive condominiums is crucial for buyers in Singapore. These limits determine the maximum amount of financing that can be obtained for purchasing an EC and play a significant role in the decision-making process. By being aware of the LTV limits and exploring different home loan options, buyers can make informed choices and find the best loan package for their needs.

How to Find the Best Home Loans in Singapore

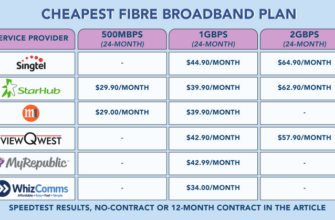

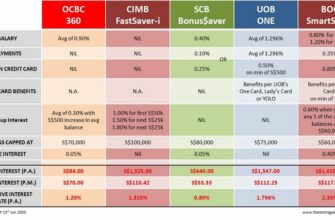

When it comes to buying a home in Singapore, finding the best home loan is crucial. With so many options available, it can be overwhelming to navigate through everything and make the right choice. One important factor to consider is the loan-to-value limits set by the banks.

Loan-to-value (LTV) limits determine how much of the property’s value you can borrow from the bank. It is important to understand these limits as they can affect the amount of down payment you need to make and the interest rates you will be charged. Different banks may have different LTV limits, so it is essential to compare and find the best option for your specific needs.

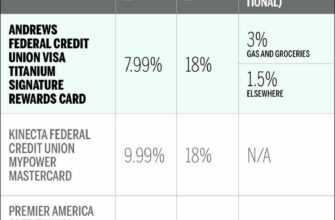

In addition to LTV limits, you should also consider the interest rates offered by different banks. Lower interest rates can save you a significant amount of money over the course of your loan. It is advisable to shop around and compare the rates offered by different banks to ensure you are getting the best deal.

Another factor to consider is the loan tenure. The loan tenure refers to the length of time you will be repaying the loan. It is important to choose a loan tenure that is manageable for you and fits within your financial goals. Longer loan tenures may result in lower monthly repayments, but it also means paying more in interest over the long run.

Lastly, it is important to consider any additional fees and charges associated with the home loan. These can include processing fees, legal fees, and valuation fees. These fees can vary from bank to bank, so it is important to factor them into your overall cost when comparing different home loan options.

In conclusion, finding the best home loan in Singapore involves considering various factors such as loan-to-value limits, interest rates, loan tenure, and additional fees. By comparing different options and understanding your own financial situation, you can make an informed decision and find the best home loan that suits your needs.

Factors to Consider when Choosing a Home Loan

When looking for the best home loans in Singapore, there are several factors that you need to consider. One of the most important factors is the loan-to-value (LTV) ratio. This ratio represents the percentage of the property’s value that the lender is willing to lend you. It is important to choose a home loan with a favorable LTV ratio to ensure that you can afford the property.

Another factor to consider when choosing a home loan is the interest rate. The interest rate will determine how much you will have to pay back over the course of the loan. It is important to compare interest rates from different lenders to find the best deal. Additionally, you should consider whether you want a fixed or variable interest rate. A fixed interest rate will remain the same throughout the loan term, while a variable interest rate may fluctuate.

It is also important to consider the loan tenure when choosing a home loan. The loan tenure refers to the length of time over which you will be repaying the loan. A longer loan tenure will result in lower monthly repayments, but you will end up paying more in interest over the long run. On the other hand, a shorter loan tenure will result in higher monthly repayments, but you will be able to pay off the loan faster and save on interest.

When choosing a home loan, it is essential to consider everything, including any additional fees and charges. Some lenders may charge processing fees, valuation fees, or legal fees. These fees can add up, so it is important to factor them into your calculations when comparing different home loan options. Additionally, you should consider any penalties or fees that may apply if you decide to refinance or repay the loan early.

In conclusion, there are several factors to consider when choosing a home loan in Singapore. These factors include the loan-to-value ratio, interest rate, loan tenure, and any additional fees and charges. By carefully considering these factors, you can find the best home loan that suits your needs and financial situation.

Comparison of Home Loan Options

When it comes to finding the best home loans in Singapore, understanding the loan-to-value limits is crucial. These limits determine how much you can borrow based on the value of the home you want to purchase. Different banks and financial institutions may have different limits, so it’s important to compare your options.

One option is to go with a traditional bank loan, which typically offers lower interest rates but may have stricter eligibility criteria. Another option is to consider a home loan from a non-bank lender, which may have more flexible requirements but higher interest rates. It’s important to weigh the pros and cons of each option and choose the one that best suits your financial situation and goals.

Additionally, it’s important to consider the loan tenure and repayment options offered by different lenders. Some lenders may offer longer loan tenures, which can result in lower monthly repayments but higher overall interest costs. Others may offer shorter loan tenures, which can lead to higher monthly repayments but lower overall interest costs. It’s important to carefully consider your cash flow and financial goals when choosing a loan tenure.

Furthermore, comparing the interest rates and fees charged by different le