- CIMB, SCB, and Citi offer some of the lowest interest rates on personal loans in Singapore.

- Overview of Personal Loans in Singapore

- CIMB Personal Loans

- Lowest Interest Rates Offered

- Flexible Repayment Options

- Quick and Easy Application Process

- Standard Chartered Bank (SCB) Personal Loans

- Competitive Interest Rates

- Flexible Loan Amounts

- Convenient Online Application

- Citi Personal Loans

- Lowest Interest Rates in the Market

- Flexible Loan Tenures

- Simple and Fast Approval Process

- Comparison of CIMB, SCB, and Citi Personal Loans

- Interest Rates

- Loan Amounts and Tenures

- Application Process

- FAQ:

- What are the interest rates for personal loans from CIMB, SCB, and Citi in Singapore?

- Are there any additional fees or charges for personal loans from CIMB, SCB, and Citi in Singapore?

- What are the eligibility criteria for personal loans from CIMB, SCB, and Citi in Singapore?

CIMB, SCB, and Citi offer some of the lowest interest rates on personal loans in Singapore.

Looking for the lowest interest rates on personal loans in Singapore? Look no further! CIMB, SCB, and Citi are here to offer you the best rates for your financial needs.

When it comes to personal loans, interest rates play a crucial role in determining the affordability of the loan. That’s why CIMB, SCB, and Citi have worked hard to provide the lowest interest rates in Singapore.

With CIMB, SCB, and Citi, you can enjoy competitive interest rates that allow you to borrow the money you need without breaking the bank. Whether you’re looking to consolidate your debts, fund a vacation, or cover unexpected expenses, our low interest rates will make it easier for you to manage your finances.

Why pay more when you can get the best rates in town? CIMB, SCB, and Citi are committed to helping you achieve your financial goals with affordable personal loan options. Take advantage of our low interest rates and enjoy flexible repayment terms that suit your needs.

Don’t miss out on the opportunity to save money on your personal loan. Contact CIMB, SCB, and Citi today to find out more about our lowest interest rates in Singapore. Get the financial assistance you need without breaking the bank!

Overview of Personal Loans in Singapore

When it comes to personal loans in Singapore, there are several banks that offer competitive rates. CIMB, SCB, and Citi are some of the banks that provide the lowest interest rates on personal loans in the country.

CIMB offers personal loans with attractive interest rates, making it an ideal choice for individuals looking for affordable financing options. With CIMB, borrowers can enjoy flexible repayment terms and quick approval processes.

SCB, another reputable bank in Singapore, also offers personal loans at low interest rates. SCB provides borrowers with various loan options to suit their financial needs, whether it’s for education, home renovations, or debt consolidation.

Citi is known for its competitive interest rates on personal loans in Singapore. With Citi, borrowers can enjoy fixed interest rates, allowing them to plan their finances better. Citi also offers flexible repayment options and quick approval processes.

Overall, CIMB, SCB, and Citi are among the banks in Singapore that provide the lowest interest rates on personal loans. Whether you’re looking to fund a major expense or consolidate your debts, these banks offer competitive rates and flexible repayment terms to meet your financial needs.

CIMB Personal Loans

Looking for the lowest interest rates on personal loans in Singapore? Look no further than CIMB Personal Loans. With CIMB, you can enjoy competitive interest rates that will help you save money on your loan.

Unlike other banks like Citi and SCB, CIMB offers some of the lowest interest rates in Singapore. This means that you can borrow the money you need without having to worry about high interest charges. CIMB understands that everyone’s financial situation is different, which is why they offer flexible repayment options to suit your needs.

With CIMB Personal Loans, you can borrow up to a certain amount of money depending on your eligibility. Whether you need a loan for a wedding, home renovation, or a dream vacation, CIMB has got you covered. They offer quick and hassle-free loan approval, so you can get the funds you need in no time.

Don’t let high interest rates hold you back from achieving your financial goals. Choose CIMB Personal Loans for the lowest interest rates in Singapore. Apply today and start saving on your loan.

Lowest Interest Rates Offered

Looking for the lowest interest rates on personal loans in Singapore? Look no further! CIMB, SCB, and Citi are offering the lowest rates in the market, making it easier than ever to get the funds you need.

At CIMB, we understand that financial flexibility is important. That’s why we offer personal loans with the lowest interest rates in Singapore. Whether you need funds for a wedding, home renovation, or education expenses, our low rates will help you achieve your goals without breaking the bank.

SCB is another trusted name when it comes to personal loans. With our lowest interest rates in Singapore, you can borrow the money you need without worrying about high monthly repayments. Whether you’re planning a dream vacation or need to consolidate your debts, SCB has you covered.

Citi is proud to offer some of the lowest interest rates on personal loans in Singapore. With our competitive rates, you can borrow the funds you need for any purpose, whether it’s to start a business or cover unexpected medical expenses. Our flexible repayment options and low interest rates make Citi the smart choice for your personal loan needs.

Don’t miss out on the lowest interest rates in Singapore. Whether you choose CIMB, SCB, or Citi, you can trust that you’re getting the best deal. Apply today and get the funds you need at the lowest rates available.

Flexible Repayment Options

Looking for flexible repayment options for your personal loan in Singapore? Look no further! CIMB, Citi, and SCB offer the lowest interest rates on personal loans, giving you the freedom to choose a repayment plan that suits your needs.

With CIMB, Citi, and SCB, you have the option to repay your loan in monthly installments, making it easier to manage your finances. You can also choose to make extra payments or pay off your loan early without any additional fees or charges.

Need some extra time to repay your loan? CIMB, Citi, and SCB offer extended repayment terms, allowing you to spread out your payments over a longer period. This can help reduce your monthly financial burden and give you more flexibility in managing your cash flow.

Not sure which repayment option is right for you? CIMB, Citi, and SCB provide personalized loan advice and assistance to help you make an informed decision. Their dedicated customer service teams are available to answer any questions you may have and guide you through the loan application process.

Don’t let high interest rates and inflexible repayment terms hold you back. Choose CIMB, Citi, or SCB for the lowest interest rates and flexible repayment options on personal loans in Singapore. Apply now and take control of your finances!

Quick and Easy Application Process

When it comes to obtaining a personal loan, choosing the right bank is crucial. That’s why CIMB, SCB, and Citi are the top choices in Singapore. Not only do they offer the lowest interest rates on personal loans, but they also provide a quick and easy application process.

With CIMB, SCB, and Citi, applying for a personal loan has never been easier. Gone are the days of lengthy paperwork and waiting in line at the bank. These banks have streamlined the application process, allowing you to apply online from the comfort of your own home.

Once you’ve submitted your application, CIMB, SCB, and Citi will quickly review your information and provide you with a decision. In most cases, you’ll receive an approval within 24 hours. This means you can get the funds you need without any unnecessary delays.

Not only is the application process quick, but it’s also hassle-free. CIMB, SCB, and Citi understand that your time is valuable, which is why they’ve made the process as simple as possible. You won’t have to jump through hoops or provide excessive documentation. Just a few basic details and you’ll be on your way to securing a personal loan.

So, if you’re in need of a personal loan in Singapore, look no further than CIMB, SCB, and Citi. With their lowest interest rates and quick and easy application process, you’ll have the funds you need in no time.

Standard Chartered Bank (SCB) Personal Loans

Looking for the lowest interest rates on personal loans in Singapore? Look no further than Standard Chartered Bank (SCB). With our competitive rates, we offer the best options for your personal loan needs.

At SCB, we understand that everyone’s financial situation is unique. That’s why we offer flexible loan terms and repayment options to suit your individual needs. Whether you need a loan for a major purchase, debt consolidation, or any other personal finance needs, SCB has got you covered.

With SCB personal loans, you can enjoy low interest rates and affordable monthly repayments. Our application process is quick and hassle-free, ensuring that you can get the funds you need when you need them.

When it comes to personal loans, SCB is the trusted choice for many Singaporeans. We have a reputation for providing excellent customer service and transparent loan terms. Plus, with our online banking platform, managing your loan and making payments is convenient and easy.

Don’t miss out on the lowest interest rates on personal loans in Singapore. Visit SCB today to find out more about our loan options and start your application process. Trust SCB to help you achieve your financial goals.

Competitive Interest Rates

If you’re looking for the lowest interest rates on personal loans in Singapore, look no further than CIMB, SCB, and Citi. These banks offer some of the most competitive rates in the market, making it easier for you to manage your finances.

With CIMB, SCB, and Citi, you can enjoy the benefits of low interest rates on your personal loans. This means that you’ll be able to save more money in the long run, as you’ll be paying less in interest fees. Whether you’re looking to consolidate your debts, fund a home renovation, or plan a dream vacation, these banks can offer you the financial support you need at a rate that suits your budget.

When it comes to personal loans, interest rates play a significant role in determining the overall cost of borrowing. CIMB, SCB, and Citi understand this, which is why they strive to provide the lowest rates possible to their customers. By choosing one of these banks, you can be confident that you’re getting a competitive rate that will help you achieve your financial goals.

In addition to offering competitive interest rates, CIMB, SCB, and Citi also provide flexible repayment terms and convenient application processes. This means that you can tailor your loan to suit your individual needs and preferences. Whether you’re looking for a short-term loan or a longer-term option, these banks have you covered.

So why wait? Take advantage of CIMB, SCB, and Citi’s lowest interest rates on personal loans in Singapore today. Start your application online or visit your nearest branch to speak with a representative who can guide you through the process. With their competitive rates and excellent customer service, these banks are the top choice for borrowers looking for affordable and reliable financing options.

Flexible Loan Amounts

Looking for a personal loan in Singapore? Look no further! With CIMB, SCB, and Citi, you can enjoy the lowest interest rates on personal loans in the country.

One of the great benefits of these lenders is that they offer flexible loan amounts. Whether you need a small loan to cover unexpected expenses or a larger loan for a major purchase, they have you covered.

With CIMB, SCB, and Citi, you can borrow the exact amount you need, no more and no less. This allows you to tailor your loan to your specific needs and ensures that you won’t be burdened with unnecessary debt.

Whether you need a personal loan for medical expenses, home renovations, or even a dream vacation, CIMB, SCB, and Citi have the perfect loan option for you. Their flexible loan amounts make it easy to get the funds you need, when you need them.

Don’t settle for high interest rates and inflexible loan options. Choose CIMB, SCB, and Citi for the lowest interest rates on personal loans in Singapore and enjoy the flexibility of choosing your own loan amount.

Convenient Online Application

When it comes to getting a personal loan in Singapore, convenience is key. That’s why Citi offers a convenient online application process for their personal loans. With just a few clicks, you can apply for a loan from the comfort of your own home.

Applying online for a personal loan with Citi is quick and easy. You can fill out the application form in just a few minutes, and you’ll receive a decision on your loan application within 24 hours. This means you don’t have to waste time waiting in line at a bank or scheduling appointments with loan officers.

With Citi’s convenient online application, you can also compare the lowest interest rates available for personal loans in Singapore. Citi offers competitive rates that can help you save money on interest payments over the life of your loan.

Whether you’re looking to consolidate debt, finance a major purchase, or cover unexpected expenses, Citi’s convenient online application for personal loans in Singapore is the smart choice. Apply today and see how easy it is to get the funds you need.

Citi Personal Loans

Looking for a personal loan with the lowest interest rates in Singapore? Look no further than Citi Personal Loans. With competitive rates and flexible repayment options, Citi is the ideal choice for your financial needs.

Unlike other banks like SCB and CIMB, Citi offers some of the lowest interest rates on personal loans in Singapore. This means you can borrow the money you need without worrying about high interest charges.

With Citi Personal Loans, you can borrow up to a certain amount, depending on your eligibility. Whether you need funds for a wedding, home renovation, or to consolidate your debts, Citi has a loan option that suits your needs.

Applying for a personal loan with Citi is quick and easy. Simply fill out the online application form and provide the necessary documents. Once approved, you can expect to receive the funds within a few business days.

Don’t let financial constraints hold you back. Take advantage of Citi’s lowest interest rates on personal loans in Singapore and make your dreams a reality. Apply for a Citi Personal Loan today!

Lowest Interest Rates in the Market

Looking for the lowest interest rates on personal loans in Singapore? Look no further! CIMB, SCB, and Citi offer the best rates in the market.

With CIMB, you can enjoy competitive interest rates on personal loans. Whether you need extra cash for a vacation or to consolidate your debt, CIMB has you covered.

SCB is another top choice for low interest rates on personal loans. They understand that every individual has different financial needs, which is why they offer flexible repayment options and affordable rates.

When it comes to personal loans, Citi is a trusted name in the industry. They offer competitive interest rates and a hassle-free application process. Whether you need funds for a home renovation or to pay off medical bills, Citi can help.

Don’t settle for high interest rates on personal loans. Choose CIMB, SCB, or Citi for the lowest rates in the market. Apply today and get the funds you need without breaking the bank.

Flexible Loan Tenures

When it comes to personal loans, having flexible loan tenures can make all the difference. At CIMB, SCB, and Citi, we understand the importance of offering our customers options that suit their individual needs. That’s why we provide a range of loan tenures to choose from, so you can find the one that works best for you.

With our flexible loan tenures, you can choose the repayment period that fits your budget and financial goals. Whether you need a shorter term to pay off your loan quickly or prefer a longer term for lower monthly repayments, we have options to suit every situation.

At CIMB, SCB, and Citi, we strive to offer the lowest interest rates on personal loans in Singapore. We understand that interest rates play a significant role in determining the affordability of a loan. That’s why we work hard to provide competitive rates that help you save money in the long run.

When you choose a personal loan from CIMB, SCB, or Citi, you can trust that you’re getting a great deal. Our low interest rates combined with flexible loan tenures make it easier for you to manage your finances and achieve your goals.

Don’t settle for high interest rates or rigid loan terms. Choose CIMB, SCB, or Citi for personal loans with flexible loan tenures that meet your needs. Apply today and take control of your financial future.

Simple and Fast Approval Process

Looking for a personal loan in Singapore? Look no further! At CIMB, SCB, and Citi, we offer the lowest interest rates on personal loans, making it easier for you to manage your finances and achieve your goals.

With our simple and fast approval process, getting a personal loan has never been easier. Whether you need funds for a home renovation, a dream vacation, or to consolidate your debts, we are here to help.

Our online application process is quick and hassle-free. Simply fill out the form on our website and submit your documents. Our team of experts will review your application and provide you with a decision in no time.

At CIMB, SCB, and Citi, we understand that time is of the essence. That’s why we strive to provide you with a fast approval process, so you can get the funds you need when you need them. No more waiting for weeks or months to get a response.

Don’t let high interest rates hold you back from achieving your dreams. Choose CIMB, SCB, and Citi for the lowest interest rates on personal loans in Singapore and experience our simple and fast approval process today.

Comparison of CIMB, SCB, and Citi Personal Loans

If you’re in need of a personal loan in Singapore, it’s important to compare the rates and interest offered by different banks. CIMB, SCB, and Citi are three popular options, each offering their own unique benefits.

CIMB is known for its low interest rates on personal loans, making it an attractive option for those looking to save money. With CIMB, you can enjoy competitive rates that are among the lowest in Singapore.

SCB, on the other hand, offers flexible repayment options for their personal loans. Whether you need a short-term loan or a longer repayment period, SCB has options that can fit your needs. Plus, their interest rates are also competitive, making it a popular choice among borrowers.

Citi is another bank that offers low interest rates on personal loans in Singapore. They also provide a range of loan amounts and repayment options, allowing you to choose the terms that work best for you. Additionally, Citi has a quick and easy application process, making it convenient for those in need of fast cash.

When comparing CIMB, SCB, and Citi personal loans, it’s important to consider factors such as interest rates, repayment options, and application process. By doing your research and comparing the options available, you can find the best personal loan in Singapore that suits your needs and budget.

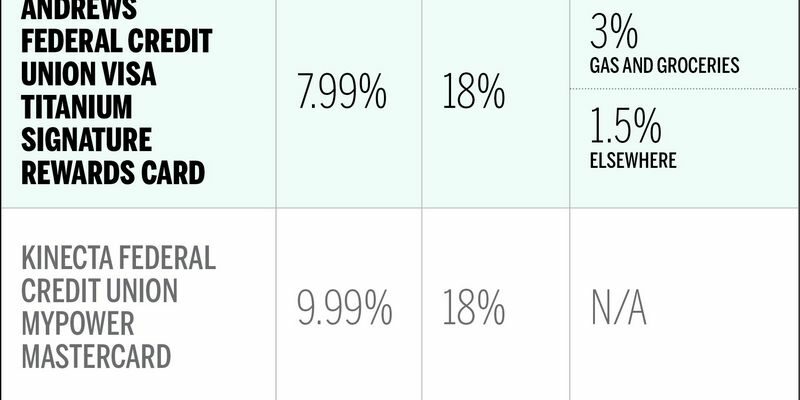

Interest Rates

Looking for the lowest interest rates on personal loans in Singapore? Look no further! CIMB, SCB, and Citi offer some of the most competitive rates in the market.

At CIMB, we understand that everyone’s financial needs are different. That’s why we offer personalized loan packages with interest rates that are tailored to your specific requirements. Whether you’re looking to consolidate debt, fund a wedding, or take a dream vacation, our low interest rates will help you achieve your goals.

SCB is another trusted name in the industry when it comes to personal loans. With our lowest interest rates, you can borrow the money you need without breaking the bank. Our flexible repayment options and quick approval process make it easy for you to get the funds you need when you need them.

Citi is known for its excellent customer service and competitive interest rates. Whether you’re a first-time borrower or a seasoned loan taker, our team of experts will guide you through the process and help you find the best loan package for your needs. With our lowest interest rates, you can save money and achieve your financial goals faster.

Don’t miss out on the opportunity to get the lowest interest rates on personal loans in Singapore. Contact CIMB, SCB, or Citi today and start your loan application. Take advantage of our competitive rates and achieve your financial dreams sooner!

Loan Amounts and Tenures

When it comes to personal loans in Singapore, CIMB, SCB, and Citi offer some of the lowest interest rates in the market. These banks provide flexible loan amounts and tenures to suit your financial needs.

With CIMB, you can borrow loan amounts ranging from SGD 1,000 to SGD 200,000, depending on your eligibility. The repayment period can be as short as 12 months or as long as 60 months, giving you the flexibility to choose a tenure that works best for you.

SCB offers loan amounts starting from SGD 1,000 up to SGD 250,000. You can choose a repayment period of up to 72 months, allowing you to spread out your repayments over a longer period of time and manage your finances more effectively.

Citi provides personal loans with loan amounts ranging from SGD 1,000 to SGD 100,000. The repayment tenure can be as short as 12 months or as long as 60 months, giving you the flexibility to choose a repayment period that fits your financial goals.

Whether you need a small loan to cover unexpected expenses or a larger loan for a major purchase, CIMB, SCB, and Citi have you covered. Their competitive interest rates and flexible loan amounts and tenures make it easier for you to achieve your financial goals without breaking the bank.

Application Process

Applying for a personal loan in Singapore has never been easier. Whether you are looking to consolidate your debts, fund a major purchase, or cover unexpected expenses, CIMB, SCB, and Citi offer the lowest interest rates on personal loans in the market.

To begin the application process, simply visit the website of your preferred bank and navigate to the personal loan section. You will find a user-friendly online application form that you can fill out at your convenience.

Before starting the application, make sure you have all the necessary documents handy. This may include proof of income, identification documents, and bank statements. Having these documents ready will help expedite the application process.

Once you have completed the online application form, submit it and wait for a response from the bank. In most cases, you will receive a decision within a few business days. If your application is approved, the bank will contact you to discuss the loan terms and finalize the process.

It is important to carefully review the loan terms and conditions before accepting the offer. Make sure you understand the interest rate, repayment period, and any additional fees or charges that may apply. If you have any questions or concerns, don’t hesitate to reach out to the bank’s customer service team for clarification.

Once you have accepted the loan offer, the funds will be disbursed to your designated bank account. From there, you can use the money for whatever purpose you need, whether it’s paying off debts, financing a wedding, or taking a much-needed vacation.

With CIMB, SCB, and Citi, applying for a personal loan in Singapore is a straightforward and hassle-free process. Take advantage of their lowest interest rates and start your application today.

FAQ:

What are the interest rates for personal loans from CIMB, SCB, and Citi in Singapore?

The interest rates for personal loans from CIMB, SCB, and Citi in Singapore are some of the lowest in the market. CIMB offers interest rates starting from 3.5% p.a., SCB offers rates starting from 3.48% p.a., and Citi offers rates starting from 3.99% p.a.

Are there any additional fees or charges for personal loans from CIMB, SCB, and Citi in Singapore?

Yes, there may be additional fees and charges for personal loans from CIMB, SCB, and Citi in Singapore. These fees may include processing fees, early repayment fees, and late payment fees. It is important to read the terms and conditions of the loan carefully to understand all the fees and charges involved.

What are the eligibility criteria for personal loans from CIMB, SCB, and Citi in Singapore?

The eligibility criteria for personal loans from CIMB, SCB, and Citi in Singapore may vary. Generally, applicants must be at least 21 years old and have a minimum annual income of S$30,000. Other criteria may include employment status, credit history, and citizenship or residency status. It is best to check with each bank directly for their specific eligibility requirements.