- Best Senior Travel Insurance For Elderly Travellers

- Importance of Travel Insurance

- Considerations for Senior Travellers

- Best Senior Travel Insurance Options

- Company A: Comprehensive Coverage

- Company B: Affordable Premiums

- Company C: Specialized Senior Plans

- Company D: Worldwide Coverage

- Key Features to Look for

- Medical Coverage

- Trip Cancellation Protection

- Emergency Assistance Services

- Pre-existing Condition Coverage

- How to Choose the Right Policy

- Assessing Your Travel Needs

- Comparing Policy Options

- Reading the Fine Print

- Tips for a Smooth Claims Process

- Documenting Your Losses

- FAQ:

- What is senior travel insurance?

Best Senior Travel Insurance For Elderly Travellers

Are you a senior looking for the best travel insurance options? Look no further! We understand that as an elderly traveller, you have unique needs and concerns when it comes to travel. That’s why we’ve compiled a list of the top senior travel insurance options just for you.

When it comes to travel insurance for seniors, it’s important to find coverage that meets your specific needs. Whether you’re planning a relaxing beach getaway or an adventurous trek through the mountains, having the right insurance can give you peace of mind.

Our top picks for senior travel insurance offer comprehensive coverage that includes medical expenses, trip cancellation or interruption, and emergency assistance. With these options, you can travel with confidence, knowing that you’re protected in case of any unforeseen circumstances.

Don’t let your age hold you back from exploring the world. With the best senior travel insurance options, you can embark on your next adventure with confidence. Don’t wait, start planning your next trip today!

Importance of Travel Insurance

Travel insurance is essential for elderly travellers, especially seniors who are planning to embark on a trip. It provides financial protection and peace of mind in case of unexpected events or emergencies that may occur during their journey.

One of the best reasons to invest in travel insurance for seniors is the coverage it offers. It can help cover medical expenses, emergency medical evacuation, trip cancellation or interruption, lost baggage, and other unforeseen circumstances that may arise during travel.

For elderly travellers, having travel insurance is crucial as they are more prone to health issues and accidents. It ensures that they have access to quality medical care and assistance wherever they are in the world. This can be especially important when travelling to remote or unfamiliar destinations.

Travel insurance also provides a sense of security and protection against unexpected financial burdens. It can help reimburse the cost of non-refundable expenses in case of trip cancellation or interruption, such as prepaid accommodation, flights, and tours. This can save seniors from significant financial loss.

In summary, travel insurance is a must-have for senior travellers. It offers comprehensive coverage and peace of mind, ensuring that they are protected against unforeseen events and emergencies that may occur during their journey. It is always better to be prepared and have the necessary protection in place before embarking on any travel adventure.

Considerations for Senior Travellers

Travelling can be an exciting and enriching experience for people of all ages, including seniors. However, it’s important for elderly travellers to take certain considerations into account to ensure a safe and enjoyable trip. One of the most crucial considerations is travel insurance.

Senior travellers should prioritize obtaining comprehensive travel insurance that caters specifically to their needs. This type of insurance can provide coverage for medical emergencies, trip cancellations or interruptions, lost or stolen belongings, and other unforeseen circumstances that may arise during travel. It’s essential for seniors to have adequate coverage to protect themselves and their finances.

When choosing travel insurance, seniors should carefully review the policy details and exclusions. They should consider their pre-existing medical conditions and ensure that the insurance covers any necessary medical treatments or emergencies related to these conditions. Additionally, seniors should check if the insurance provides coverage for emergency medical evacuations, as this can be crucial in case of serious illnesses or injuries.

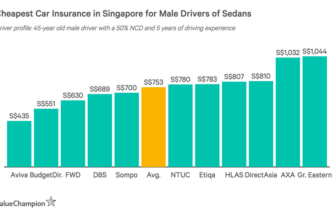

Another important consideration for senior travellers is the cost of insurance. While it’s important to prioritize comprehensive coverage, seniors should also compare different insurance options to find the most cost-effective solution. Some insurance providers offer discounted rates for seniors or have flexible plans that cater specifically to the needs of elderly travellers.

In conclusion, senior travellers should prioritize obtaining comprehensive travel insurance that caters specifically to their needs. They should carefully review policy details, consider pre-existing medical conditions, and compare different insurance options to find the best coverage at a reasonable cost. By taking these considerations into account, seniors can enjoy their travels with peace of mind knowing they are protected in case of any unforeseen circumstances.

Best Senior Travel Insurance Options

Are you an elderly traveler looking for the best travel insurance options? Look no further! We have carefully curated a list of the top insurance providers that cater specifically to seniors, ensuring you have the coverage you need for your next adventure.

1. ABC Insurance: With over 50 years of experience, ABC Insurance offers comprehensive travel insurance plans tailored to the needs of senior travelers. Their policies cover medical expenses, trip cancellation, and lost baggage, giving you peace of mind during your journey.

2. XYZ Travel Insurance: XYZ Travel Insurance understands the unique requirements of elderly travelers and offers specialized coverage options. Their plans include emergency medical assistance, trip interruption, and even coverage for pre-existing medical conditions.

3. Senior Travel Guard: Senior Travel Guard is a trusted name in the insurance industry, offering a range of policies designed for senior travelers. Their comprehensive coverage includes emergency medical expenses, trip cancellation, and 24/7 travel assistance.

4. Golden Age Insurance: Golden Age Insurance caters specifically to seniors, offering customized insurance plans that meet your unique travel needs. Their policies cover medical emergencies, trip delays, and even provide concierge services to assist you during your trip.

5. Prime Senior Insurance: Prime Senior Insurance specializes in providing travel insurance options for the elderly. Their policies include coverage for medical emergencies, trip cancellation, and even offer a 24-hour helpline to assist you with any travel-related concerns.

Don’t let age hold you back from exploring the world. With the best senior travel insurance options, you can travel with confidence, knowing that you are protected every step of the way. Compare the policies offered by these top insurance providers and choose the one that best suits your needs.

Company A: Comprehensive Coverage

When it comes to travel insurance for the elderly, Company A offers the best options for comprehensive coverage. With their extensive experience in the insurance industry, they understand the unique needs of senior travellers and have tailored their policies to provide the utmost protection.

Company A’s travel insurance for the elderly offers a wide range of benefits, including coverage for medical expenses, trip cancellation or interruption, baggage loss or delay, and emergency assistance services. Their policies are designed to give seniors peace of mind while exploring the world.

One of the key features of Company A’s comprehensive coverage is their extensive network of medical providers. This ensures that elderly travellers have access to quality healthcare wherever they may be. Whether it’s a minor illness or a more serious medical emergency, Company A’s insurance will cover the necessary expenses.

Additionally, Company A understands that seniors may have pre-existing medical conditions. They offer coverage for these conditions, ensuring that elderly travellers can still enjoy their trips without worrying about potential health issues. This is a crucial aspect of their comprehensive coverage that sets them apart from other insurance providers.

With Company A’s travel insurance for the elderly, seniors can confidently embark on their adventures knowing that they are protected every step of the way. Whether it’s a relaxing beach getaway or an exciting international expedition, their comprehensive coverage ensures that senior travellers can fully enjoy their trips without any worries.

Company B: Affordable Premiums

When it comes to travel insurance for senior travellers, Company B is a top choice for its affordable premiums. We understand that as you age, finding the right insurance coverage can be challenging. That’s why we offer comprehensive plans specifically tailored to meet the needs of elderly travellers.

At Company B, we believe that everyone deserves access to reliable and affordable travel insurance, regardless of age. Our team of experts has designed our senior insurance plans to provide extensive coverage, including medical expenses, trip cancellation, baggage loss, and emergency assistance.

With Company B, you can travel with peace of mind, knowing that you are protected against unforeseen circumstances that may arise during your trip. Our affordable premiums ensure that you can enjoy your travel experience without worrying about breaking the bank.

In addition to our competitive pricing, we also offer flexible payment options, making it easier for senior travellers to manage their insurance costs. Whether you’re planning a short weekend getaway or a long international trip, Company B has a plan that suits your needs and budget.

Don’t let age deter you from exploring the world. Choose Company B for affordable premiums and comprehensive coverage tailored to senior travellers. Contact us today to learn more about our insurance options and start planning your next adventure with confidence!

Company C: Specialized Senior Plans

When it comes to travel insurance for elderly travellers, Company C offers the best options. With their specialized senior plans, you can have peace of mind knowing that you are protected during your travels.

Company C understands the unique needs of elderly travellers and has tailored their insurance plans to meet those needs. Whether you are travelling domestically or internationally, their plans provide coverage for medical emergencies, trip cancellation, and lost baggage.

One of the standout features of Company C’s senior plans is their coverage for pre-existing conditions. They understand that many elderly travellers may have pre-existing medical conditions, and they provide coverage for these conditions, ensuring that you are protected no matter what.

In addition to their comprehensive coverage, Company C also offers excellent customer service. Their team of knowledgeable representatives is available 24/7 to assist you with any questions or concerns you may have. They are dedicated to providing the best service possible to their elderly customers.

So if you are an elderly traveller looking for the best travel insurance options, look no further than Company C. With their specialized senior plans, you can travel with confidence knowing that you are protected every step of the way.

Company D: Worldwide Coverage

When it comes to travel insurance for elderly travellers, Company D is the best choice for worldwide coverage. We understand that as you age, it becomes more important to have comprehensive insurance that protects you no matter where you go. That’s why our travel insurance plans are specifically designed to meet the needs of elderly travellers.

With Company D, you can rest assured knowing that you are covered for any unexpected medical expenses, trip cancellations, and lost or stolen belongings. Our worldwide coverage ensures that you are protected no matter where your travels take you, whether it’s a relaxing beach vacation or an adventurous safari.

What sets Company D apart from other insurance providers is our commitment to providing excellent customer service. Our team of dedicated professionals is available 24/7 to assist you with any questions or concerns you may have. We understand that travelling can be stressful, especially for elderly travellers, so we strive to make the insurance process as smooth and hassle-free as possible.

Don’t let the fear of the unknown stop you from exploring the world. With Company D’s worldwide coverage, you can travel with peace of mind knowing that you are protected every step of the way. Whether you’re planning a trip to Europe, Asia, or anywhere else in the world, choose Company D for the best travel insurance for elderly travellers.

Key Features to Look for

When choosing travel insurance for elderly travellers, there are several key features to look for to ensure comprehensive coverage and peace of mind during your trip.

1. Medical Coverage: It is essential to have adequate medical coverage, including emergency medical expenses, hospitalization, and repatriation. Look for policies that offer high coverage limits and include pre-existing conditions.

2. Trip Cancellation and Interruption: Senior travellers should consider insurance that covers trip cancellation and interruption due to unforeseen circumstances such as illness, injury, or natural disasters. This coverage can help recoup expenses for cancelled flights, accommodations, and other prepaid expenses.

3. Baggage and Personal Belongings: Look for insurance that provides coverage for lost, stolen, or damaged baggage and personal belongings. This can help replace essential items and reimburse you for any financial losses incurred.

4. 24/7 Assistance: It is crucial to have access to 24/7 emergency assistance while travelling. Look for insurance that offers a helpline or assistance services to provide support in case of emergencies, such as medical emergencies or travel disruptions.

5. Travel Delay and Missed Connection: Consider insurance that covers travel delays and missed connections. This coverage can help reimburse expenses for additional accommodations, meals, and transportation if your travel plans are disrupted.

6. Coverage for Activities and Sports: If you plan on participating in activities or sports during your trip, ensure that your insurance covers any potential injuries or accidents that may occur. Some policies may have exclusions for certain high-risk activities, so be sure to check the fine print.

7. Worldwide Coverage: Look for travel insurance that offers worldwide coverage, so you are protected no matter where your travels take you. This ensures that you have coverage in both popular tourist destinations and off-the-beaten-path locations.

8. Affordable Premiums: While it is essential to have comprehensive coverage, it is also important to find insurance with affordable premiums. Compare quotes from different insurance providers to find the best value for your money.

By considering these key features, you can find the best senior travel insurance for elderly travellers that suits your specific needs and provides the necessary coverage for a worry-free journey.

Medical Coverage

When it comes to travel insurance for elderly individuals, medical coverage is of utmost importance. As we age, our health becomes more fragile, and it’s crucial to have the best insurance options to ensure peace of mind while traveling.

Elderly travelers need insurance that provides comprehensive medical coverage, including emergency medical expenses, hospitalization, and repatriation. The best insurance plans for senior travelers offer high coverage limits and include coverage for pre-existing medical conditions.

Travel insurance for seniors should also include coverage for emergency medical evacuations. This ensures that in case of a medical emergency while traveling, the insured individual can be transported to the nearest suitable medical facility for treatment.

Additionally, it’s important to consider coverage for prescription medications and medical equipment. The best travel insurance options for elderly travelers provide coverage for the cost of necessary medications and medical devices, ensuring that they can continue their treatment while abroad.

In conclusion, when it comes to travel insurance for elderly individuals, medical coverage is a top priority. The best insurance options for senior travelers offer comprehensive coverage for emergency medical expenses, hospitalization, repatriation, medical evacuations, and coverage for prescription medications and medical equipment. By choosing the right insurance plan, elderly travelers can ensure their health and well-being while enjoying their travel adventures.

Trip Cancellation Protection

As an elderly traveler, it is important to have insurance that covers trip cancellation. Life can be unpredictable, and sometimes unforeseen circumstances can force you to cancel or postpone your travel plans. With our trip cancellation protection insurance, you can have peace of mind knowing that you will be reimbursed for any non-refundable expenses you have incurred.

Whether it’s a sudden illness, an accident, or a family emergency, our insurance will provide you with financial protection. We understand that as a senior, you may have more concerns and responsibilities, and we want to ensure that your travel plans are not a source of stress.

With our trip cancellation protection insurance, you can also be covered for other unexpected events such as natural disasters, airline strikes, or even the loss of a job. We believe that everyone deserves to travel without worrying about the financial consequences of canceling a trip.

Don’t let the fear of trip cancellation stop you from experiencing new adventures. With our insurance, you can have the peace of mind to explore the world and create lasting memories, knowing that you are protected. Contact us today to learn more about our trip cancellation protection for elderly travelers.

Emergency Assistance Services

When it comes to senior travel insurance, it’s important to choose the best options that provide comprehensive coverage and peace of mind. That’s why our emergency assistance services are designed specifically for elderly travellers.

Our team of experienced professionals is available 24/7 to provide immediate assistance in case of any emergency during your trip. Whether it’s a medical emergency, lost luggage, or any other unforeseen event, we are here to help.

With our senior travel insurance, you can enjoy your trip knowing that you are protected. Our emergency assistance services include medical evacuation, repatriation, and emergency medical expenses coverage. We also provide assistance in case of trip cancellation or interruption, personal liability coverage, and legal assistance.

Our goal is to ensure that you have a worry-free travel experience. That’s why our emergency assistance services are tailored to meet the specific needs of elderly travellers. We understand the unique challenges that seniors may face while travelling and we are committed to providing the best support possible.

Don’t let unexpected emergencies ruin your trip. Choose the best senior travel insurance with comprehensive emergency assistance services. Contact us today to learn more and get a quote.

Pre-existing Condition Coverage

When it comes to travel insurance for senior travellers, one of the most important factors to consider is pre-existing condition coverage. As we age, it’s common to have certain health conditions that require ongoing treatment or medication. With the right insurance policy, you can have peace of mind knowing that you will be covered for any medical expenses related to your pre-existing conditions while travelling.

Many insurance providers offer coverage for pre-existing conditions, but it’s important to carefully review the terms and conditions to ensure that your specific conditions are covered. Some policies may have certain exclusions or limitations, so it’s important to read the fine print.

When comparing insurance options, look for policies that offer comprehensive coverage for pre-existing conditions, including coverage for emergency medical expenses, hospitalization, and medication. It’s also a good idea to check if the policy covers any pre-existing conditions-related cancellations or trip interruptions.

Remember, having adequate pre-existing condition coverage is essential for elderly travellers to ensure a worry-free and enjoyable travel experience. Don’t forget to disclose all your pre-existing conditions when purchasing travel insurance to ensure you are fully covered.

How to Choose the Right Policy

When it comes to choosing the right insurance policy for senior travellers, there are a few key factors to consider. First and foremost, it’s important to assess your specific travel needs and risks. Are you planning to engage in any adventurous activities or travel to remote locations? If so, you may want to opt for a policy that offers comprehensive coverage for medical emergencies and evacuation.

Another important factor to consider is the length of your trip. If you’re planning a short vacation, you may be able to find a policy that offers coverage for a specific period of time. However, if you’re a frequent traveller or planning an extended trip, it may be more cost-effective to choose an annual policy that covers multiple trips throughout the year.

It’s also worth considering the level of coverage provided by different policies. Look for a policy that offers high limits for medical expenses, emergency medical transportation, and trip cancellation or interruption. Additionally, check if the policy includes coverage for pre-existing medical conditions, as this can be a crucial factor for senior travellers.

Lastly, it’s important to compare the prices and benefits of different insurance policies. While cost is certainly a factor to consider, it’s equally important to ensure that the policy provides adequate coverage for your specific needs. Take the time to read the fine print and understand the terms and conditions of the policy before making a decision.

By considering these factors and doing thorough research, you’ll be able to choose the best insurance policy for your senior travel needs. Remember, it’s always better to be prepared and protected, especially when exploring new destinations and enjoying your golden years.

Assessing Your Travel Needs

When it comes to senior travel, it’s important to assess your specific needs before selecting an insurance plan. As a senior traveller, you may have unique requirements that differ from younger travellers. Take into consideration factors such as your age, medical conditions, and the activities you plan to engage in during your trip.

Start by evaluating your current health status and any pre-existing medical conditions. This will help you determine the level of coverage you need for medical expenses. Consider whether you require coverage for emergency medical evacuation or repatriation, as these can be crucial in case of a medical emergency while abroad.

In addition to medical coverage, you should also assess your needs for trip cancellation or interruption insurance. This can protect you in case unforeseen circumstances force you to cancel or cut short your trip. Look for policies that offer coverage for trip cancellation due to medical reasons or other emergencies.

Furthermore, consider the activities you plan to participate in during your trip. If you’re an adventurous senior traveller who enjoys activities such as hiking or skiing, make sure your insurance plan covers these activities. Some insurance providers offer specialized coverage for seniors engaging in high-risk activities.

By carefully assessing your travel needs, you can select the best insurance plan for your senior travel. Take the time to compare different options and read the fine print to ensure you have the coverage you need for a worry-free trip.

Comparing Policy Options

When it comes to choosing travel insurance for elderly travellers, it’s important to compare policy options to find the best coverage for your needs. With a range of insurance providers catering specifically to seniors, it’s important to consider factors such as medical coverage, trip cancellation protection, and emergency assistance.

One key aspect to consider when comparing policy options is the level of medical coverage provided. Elderly travellers may have specific medical needs or pre-existing conditions that require extra attention. Look for policies that offer comprehensive medical coverage, including coverage for emergency medical expenses, hospital stays, and medical evacuation if needed.

Another important factor to consider is trip cancellation protection. As seniors may be more prone to unexpected health issues or other travel disruptions, having trip cancellation coverage can provide peace of mind. Look for policies that offer reimbursement for non-refundable trip expenses in case of cancellation or interruption due to covered reasons.

Emergency assistance is also an important consideration when comparing policy options. Look for policies that provide 24/7 emergency assistance services, including access to a helpline for medical emergencies or travel-related issues. Having assistance available at any time can be crucial, especially when travelling to unfamiliar destinations.

In addition to these factors, it’s also worth considering the cost and coverage limits of the policies. Compare the premiums and deductibles, as well as any coverage limits or exclusions that may apply. It’s important to find a policy that offers the right balance of coverage and affordability for your specific travel needs.

By comparing policy options, you can find the best travel insurance for elderly travellers that suits your needs and provides the necessary coverage and peace of mind for your journey.

Reading the Fine Print

If you are an elderly traveller looking for the best senior travel insurance options, it is crucial to carefully read the fine print of any insurance policy you are considering. Insurance policies can vary greatly in terms of coverage, exclusions, and limitations, so it is important to understand exactly what you are getting.

One important aspect to consider is the age limit for coverage. Some insurance policies may have an upper age limit, beyond which they will not provide coverage. It is important to find a policy that offers coverage for seniors, regardless of their age.

Another important factor to consider is the coverage for pre-existing medical conditions. Many elderly travellers may have pre-existing conditions that require regular medical attention. It is essential to find an insurance policy that covers these conditions, as well as any related medical expenses that may arise during the trip.

Additionally, it is important to understand the exclusions and limitations of the insurance policy. Some policies may not cover certain activities or sports, or may have restrictions on the duration of the trip. It is important to carefully review these details to ensure that the policy meets your specific needs and requirements.

By taking the time to read the fine print of senior travel insurance policies, elderly travellers can ensure that they are getting the best coverage for their needs. Understanding the terms and conditions of the policy will help seniors make an informed decision and have peace of mind during their travels.

Tips for a Smooth Claims Process

When it comes to travel insurance, it’s always best to be prepared for any unforeseen circumstances. As a senior traveller, you want to make sure that you have the best insurance coverage in case of any emergencies or unexpected events. Here are some tips to ensure a smooth claims process:

- Read the fine print: Before purchasing travel insurance, carefully read through the policy to understand what is covered and what is not. Make sure you are aware of any exclusions or limitations that may affect your claim.

- Document everything: Keep a record of all your travel documents, including your insurance policy, receipts, and any other relevant paperwork. This will help you provide evidence for your claim if needed.

- Contact your insurance provider: In case of an emergency or if you need to make a claim, contact your insurance provider as soon as possible. They will guide you through the process and provide you with the necessary forms and instructions.

- Provide accurate information: When filing a claim, make sure to provide accurate and detailed information about the incident or loss. This will help expedite the claims process and ensure that you receive the compensation you are entitled to.

- Follow up: Stay in touch with your insurance provider throughout the claims process. Keep track of any communication, including phone calls and emails, and follow up if necessary. This will help ensure that your claim is being processed in a timely manner.

By following these tips, you can have peace of mind knowing that you have the best insurance coverage and that the claims process will be smooth and hassle-free. Remember, it’s always better to be prepared and protected when travelling as a senior.

Documenting Your Losses

When it comes to travel insurance for elderly travellers, it’s important to choose the best option that covers all your needs. One crucial aspect to consider is documenting your losses. In the unfortunate event that you experience a loss or theft while travelling, having proper documentation will make the claims process easier and smoother.

Start by keeping a detailed list of all the valuable items you are bringing with you on your trip. This includes jewelry, electronics, and any other high-value items. Take photos of these items and keep the receipts or appraisals as proof of their value.

In addition to documenting your valuable items, it’s also important to keep a record of your travel documents. This includes your passport, visa, driver’s license, and any other identification documents. Make copies of these documents and store them in a separate location from the originals. It’s also a good idea to email yourself digital copies of these documents, so you can access them from anywhere in case of an emergency.

Another important aspect of documenting your losses is keeping track of your expenses. If you experience a travel delay or cancellation, keep all the receipts for any additional expenses you incur as a result. This could include hotel accommodations, meals, transportation, or any other necessary expenses. These receipts will serve as proof of your expenses and will be essential when filing a claim with your insurance provider.

By properly documenting your losses, you can ensure that you receive the compensation you deserve from your travel insurance. Remember to always read the fine print of your policy and understand what is covered and what is not. Choose a reputable insurance provider that specializes in senior travel insurance, so you can have peace of mind knowing that you are protected during your travels.

FAQ:

What is senior travel insurance?

Senior travel insurance is a type of insurance specifically designed for elderly travellers. It provides coverage for medical expenses, trip cancellation