- Discover how to best manage and invest your money to fund life’s ambitions

- Understanding Money Management

- Importance of Investing

- Setting Financial Goals

- Budgeting for Success

- Saving Strategies

- Diversifying Your Investments

- Risk Management

- Long-Term vs Short-Term Investments

- Investment Options

- Retirement Planning

- Real Estate Investing

- Stock Market Basics

- Understanding Bonds

- Building an Investment Portfolio

- Tax Strategies

- Evaluating Investment Opportunities

- Putting It All Together

- FAQ:

- What is “Unlocking the Secrets to Effective Money Management and Investing for Life’s Ambitions” about?

- Who is the author of “Unlocking the Secrets to Effective Money Management and Investing for Life’s Ambitions”?

- Is “Unlocking the Secrets to Effective Money Management and Investing for Life’s Ambitions” suitable for beginners?

- What are some of the topics covered in “Unlocking the Secrets to Effective Money Management and Investing for Life’s Ambitions”?

- Can “Unlocking the Secrets to Effective Money Management and Investing for Life’s Ambitions” help me achieve my financial goals?

Discover how to best manage and invest your money to fund life’s ambitions

Discover the key to unlocking your life’s ambitions and achieving financial success. With our proven strategies and expert guidance, you can learn how to effectively manage your money and make it work for you.

Managing your funds is an essential skill that can pave the way to achieving your dreams. Whether you have short-term goals like buying a new car or long-term ambitions like starting your own business, understanding how to make your money grow is crucial.

Our team of financial experts will teach you the secrets to money management and investing that can help you reach your life’s ambitions. We will guide you through the process of creating a budget, setting financial goals, and developing a personalized investment plan.

Don’t let your money control you. Take control of your finances and start making smart decisions today. Unlock the secrets to effective money management and investing for life’s ambitions with our comprehensive program.

Remember, your financial future is in your hands. Start managing your money effectively and make your dreams a reality.

Understanding Money Management

When it comes to life’s ambitions, managing your money effectively is crucial. Whether you have a specific goal in mind, such as buying a house or starting a business, or simply want to build a secure financial future, understanding how to manage your funds is key.

With the help of our “Understanding Money Management” program, you will discover the secrets to successful money management. We will teach you how to create a budget, track your expenses, and prioritize your financial goals. By gaining a deeper understanding of your spending habits, you will be able to make informed decisions about how to best allocate your money.

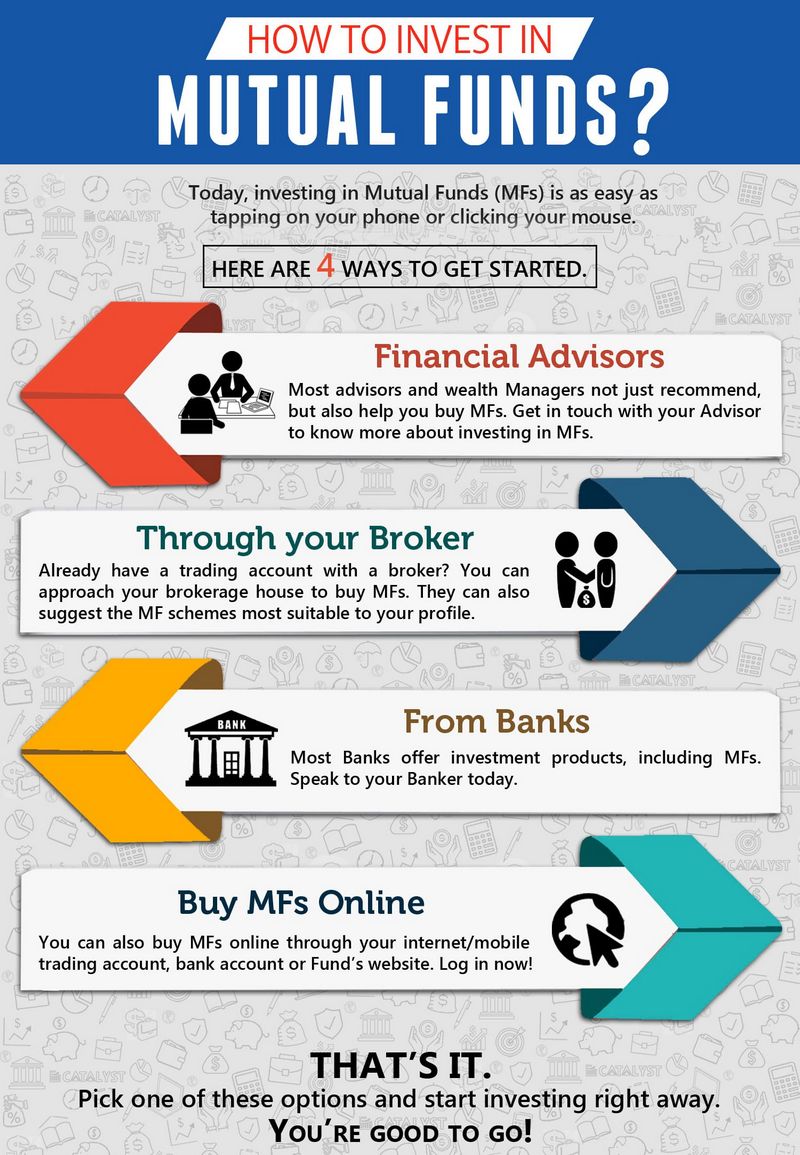

Furthermore, our program will guide you in learning about different investment opportunities. From stocks and bonds to real estate and mutual funds, we will provide you with the knowledge and tools to invest your money wisely. By understanding the risks and rewards associated with each investment option, you will be able to make confident decisions that align with your long-term financial goals.

Don’t let money management be a mystery any longer. Take control of your financial future and unlock the secrets to effective money management with our “Understanding Money Management” program. Start your journey today and invest in your future success.

Importance of Investing

Investing plays a crucial role in managing life’s ambitions and achieving financial stability. It is a strategic way to grow your money and ensure a secure future. By investing wisely, you can make your money work for you and create a fund that can support your long-term goals.

One of the key benefits of investing is the potential for higher returns compared to traditional saving methods. By putting your money into various investment vehicles such as stocks, bonds, or real estate, you have the opportunity to earn more than what you would with a regular savings account. This allows you to build wealth over time and have the means to fulfill your ambitions.

Investing also helps in managing money effectively. It encourages discipline and long-term thinking, as you need to carefully analyze and evaluate investment options before making decisions. This process forces you to understand the market, assess risks, and make informed choices, which can greatly enhance your financial management skills.

Furthermore, investing provides the opportunity to discover new opportunities and industries. By diversifying your portfolio, you can explore different sectors and potentially benefit from emerging trends. This not only helps you stay ahead of the curve but also opens doors to new possibilities and ventures.

In conclusion, investing is of utmost importance when it comes to managing your money and achieving life’s ambitions. It allows you to grow your wealth, manage your finances effectively, and discover new opportunities. Start investing today and unlock the secrets to financial success.

Setting Financial Goals

Setting financial goals is an essential step towards achieving financial stability and success. It involves identifying your monetary ambitions and creating a plan to manage your money effectively. Whether you want to fund your dream vacation, invest in a business venture, or save for retirement, setting financial goals allows you to prioritize your spending and make informed decisions about how to allocate your resources.

By setting financial goals, you can discover what truly matters to you and align your money management strategies accordingly. Whether you want to invest in your education, start a family, or buy a house, having clear goals will guide your financial decisions and help you stay focused on achieving your ambitions.

Managing your money towards your goals requires discipline and a well-thought-out plan. It involves making smart choices about budgeting, saving, and investing. By tracking your expenses, cutting unnecessary costs, and finding ways to increase your income, you can ensure that your money is working for you and getting you closer to your ambitions.

Setting financial goals also gives you a sense of control over your money. It allows you to prioritize your spending and make conscious decisions about where your money goes. By creating a roadmap for your financial journey, you can stay motivated and focused on achieving your goals, no matter how big or small they may be.

Overall, setting financial goals is a powerful tool for managing your money and achieving your ambitions. It empowers you to take control of your finances, invest wisely, and make informed decisions about how to use your money to create the life you desire.

Budgeting for Success

Are you ready to take control of your financial future? With “Budgeting for Success,” you can learn how to effectively manage and invest your money to achieve your life’s ambitions. Whether you want to save for a dream vacation, start a business, or fund your child’s education, this program will provide you with the tools and knowledge you need to make informed financial decisions.

Discover the secrets to creating a realistic budget that works for you. Learn how to track your expenses and identify areas where you can save money. With our step-by-step guide, you’ll be able to develop a personalized budget that aligns with your goals and priorities.

Investing can be intimidating, but with “Budgeting for Success,” you’ll gain the confidence to make smart investment decisions. We’ll teach you how to research different investment options, assess risk, and build a diversified portfolio. Whether you’re a beginner or have some experience, our program will help you navigate the complex world of investing.

Don’t let your financial goals remain out of reach. Take charge of your money and start budgeting for success today. Sign up for our program and unlock the secrets to effective money management and investing for life’s ambitions.

Saving Strategies

Are you ready to take control of your financial future and achieve your life’s ambitions? Discover the power of saving strategies that can help you build a strong foundation for your money. By implementing these strategies, you can effectively manage your finances, invest wisely, and fund your dreams.

One key saving strategy is to create a budget that aligns with your goals and priorities. This will allow you to track your expenses, identify areas where you can cut back, and save more money for the things that truly matter to you. By saving consistently, you can build up a substantial fund over time that can be used to invest in opportunities that will help you achieve your ambitions.

Another important saving strategy is to automate your savings. By setting up automatic transfers from your checking account to a separate savings account, you can ensure that a portion of your income is consistently being saved. This not only makes saving easier and more convenient, but it also helps to remove the temptation to spend money impulsively.

Additionally, consider exploring different investment options to grow your savings even further. Whether it’s stocks, bonds, real estate, or mutual funds, investing can provide opportunities for your money to work for you and generate returns over time. However, it’s important to do your research and seek professional advice to ensure that you make informed investment decisions that align with your risk tolerance and financial goals.

By implementing these saving strategies, you can take control of your money, invest wisely, and fund your life’s ambitions. Start today and unlock the secrets to effective money management and investing for a brighter financial future.

Diversifying Your Investments

When it comes to managing your money and investing for life’s ambitions, it’s important to have a diverse portfolio. Diversifying your investments can help you spread the risk and increase your chances of achieving your financial goals.

One way to diversify your investments is by investing in different asset classes. This can include stocks, bonds, real estate, and commodities. Each asset class has its own risk and return characteristics, so by investing in a mix of these, you can reduce the impact of any one investment on your overall portfolio.

Another way to diversify is by investing in different sectors or industries. By spreading your investments across various sectors such as technology, healthcare, and consumer goods, you can reduce the risk of being heavily exposed to one sector’s performance.

Furthermore, you can diversify your investments by investing in different geographic regions. This can help you benefit from global economic growth and reduce the impact of any one country’s economic performance on your portfolio.

Discovering new investment opportunities is also crucial for diversifying your portfolio. By staying informed about market trends and emerging industries, you can identify new investment options that have the potential for high returns.

Overall, diversifying your investments is a key strategy for managing your money and investing for life’s ambitions. By spreading your investments across different asset classes, sectors, and geographic regions, you can reduce risk and increase the likelihood of achieving your financial goals.

Risk Management

Investing in life’s ambitions requires careful planning and strategy. One of the key elements of successful financial planning is risk management. By understanding and managing the risks associated with your investments, you can protect and grow your funds for the future.

Discovering how to effectively manage risk is essential for any investor. It involves identifying potential risks, analyzing their potential impact, and implementing strategies to mitigate those risks. Whether you’re investing in stocks, bonds, or real estate, understanding risk management can help you make informed decisions and protect your investments.

Managing risk also involves diversifying your investment portfolio. By spreading your funds across different asset classes and industries, you can reduce the impact of any single investment on your overall portfolio. This strategy helps to protect against market volatility and potential losses.

Additionally, risk management involves setting realistic expectations and understanding the potential rewards and drawbacks of different investment opportunities. It’s important to carefully assess the potential risks and rewards of each investment before making a decision. This can help you avoid unnecessary risks and make more informed investment choices.

In summary, effective risk management is a crucial component of successful money management and investing for life’s ambitions. By understanding and managing the risks associated with your investments, you can protect and grow your funds for the future. Take the time to discover and implement effective risk management strategies to maximize your investment potential.

Long-Term vs Short-Term Investments

When it comes to managing your money and investing for your life’s ambitions, it’s important to understand the difference between long-term and short-term investments. Both types of investments have their own benefits and risks, and it’s crucial to make informed decisions based on your financial goals and time horizon.

Long-term investments are typically held for a period of five years or more. These investments are designed to grow over time and provide a higher return on investment. Examples of long-term investments include stocks, mutual funds, and real estate. By investing in these assets, you can take advantage of compounding returns and potentially earn significant profits.

On the other hand, short-term investments are typically held for a period of one year or less. These investments are more liquid and can be easily converted into cash. Examples of short-term investments include money market funds, certificates of deposit, and treasury bills. While short-term investments may not offer the same level of return as long-term investments, they provide a way to preserve capital and earn a modest amount of interest.

Deciding whether to invest in long-term or short-term investments depends on your individual financial situation and goals. If you have a long-term financial goal, such as retirement or buying a house, it may be wise to allocate a portion of your funds towards long-term investments. On the other hand, if you have a short-term goal, such as saving for a vacation or a down payment on a car, short-term investments may be more suitable.

In conclusion, understanding the difference between long-term and short-term investments is essential for effective money management. By carefully considering your financial goals and time horizon, you can make informed decisions and invest your money wisely. Whether you choose to invest in long-term or short-term investments, it’s important to diversify your portfolio and seek professional advice when needed. Start discovering the world of investing today and unlock the secrets to achieving your life’s ambitions.

Investment Options

Are you looking to discover new investment options to help you achieve your life’s ambitions? Look no further. Our team of experts can help you manage your money wisely and make smart investment decisions.

With our wide range of investment options, you can choose the ones that align with your goals and risk tolerance. Whether you’re looking to invest in stocks, bonds, mutual funds, or real estate, we have the tools and knowledge to guide you in the right direction.

Investing is not just about making money; it’s about securing your future and realizing your dreams. By investing wisely, you can build wealth and create a financial legacy for yourself and your loved ones.

Our investment options are designed to cater to various financial goals and time horizons. Whether you’re saving for retirement, planning to buy a house, or funding your child’s education, we have investment strategies that can help you reach your targets.

Don’t let your money sit idle. Start investing today and unlock the secrets to effective money management. Let us help you make the most of your financial resources and turn your ambitions into reality.

Retirement Planning

Are you ready to take control of your financial future? Retirement planning is essential for achieving your life’s ambitions and ensuring a comfortable future. It’s never too early or too late to start thinking about how to invest and manage your money for retirement.

With retirement planning, you can create a solid financial foundation that will support you throughout your golden years. Whether you dream of traveling the world, starting a new business, or simply enjoying a worry-free retirement, a well-managed retirement fund is the key to making those ambitions a reality.

Investing in your retirement now means you can enjoy the fruits of your labor later. By contributing to a retirement fund, you are building a nest egg that will provide you with financial security and peace of mind. With the right investment strategy, you can grow your money over time and ensure a comfortable retirement.

Managing your retirement fund is crucial to your long-term financial success. By regularly reviewing and adjusting your investment portfolio, you can maximize returns and minimize risks. A well-diversified portfolio that includes a mix of stocks, bonds, and other assets can help protect your money and ensure it continues to grow.

Don’t wait until it’s too late to start planning for your retirement. Take control of your financial future now and invest in a retirement plan that aligns with your goals and ambitions. With the right guidance and a well-thought-out strategy, you can create the retirement lifestyle you’ve always dreamed of.

Real Estate Investing

Discover the power of real estate investing and unlock the secrets to financial success. With real estate, you have the opportunity to grow your fund and make your money work for you.

Investing in real estate is a smart way to secure your financial future and achieve your life’s ambitions. Whether you are looking to build wealth, generate passive income, or diversify your investment portfolio, real estate offers endless possibilities.

With real estate investing, you can tap into the potential of property appreciation and rental income. By investing in properties, you can take advantage of the growing demand for housing and secure a steady stream of cash flow.

Don’t miss out on the opportunity to invest in real estate and unlock the secrets to financial freedom. Start building your real estate portfolio today and take control of your financial future.

Stock Market Basics

Discover the key principles and strategies to effectively manage and invest your money in the stock market. Whether you’re a beginner or an experienced investor, understanding the basics of the stock market is crucial for achieving your life’s financial ambitions.

Learn how to analyze and interpret stock market trends, identify potential investment opportunities, and make informed decisions. Gain the knowledge and skills to navigate the complexities of the stock market and maximize your returns.

With Stock Market Basics, you’ll gain a solid foundation in financial literacy and develop the confidence to take control of your financial future. Understand the different types of stocks, how to evaluate their performance, and the risks involved. Explore various investment strategies, such as value investing, dividend investing, and growth investing, to build a diversified portfolio that aligns with your goals.

Take advantage of the resources and tools available to investors, from online trading platforms to financial news and research sources. Learn how to read financial statements, interpret market indicators, and stay up-to-date with the latest market news and trends. Develop the discipline and patience required for successful long-term investing.

Investing in the stock market can be a powerful tool for achieving your life’s ambitions. Start your journey to financial independence and unlock the secrets to effective money management and investing with Stock Market Basics.

Understanding Bonds

Are you looking to manage your money and invest in a way that aligns with your ambitions? If so, it’s important to discover the world of bonds. Bonds are a type of investment that allow you to lend money to a company or government in exchange for regular interest payments and the return of your initial investment at maturity.

By investing in bonds, you can diversify your portfolio and potentially earn a steady income stream. Bonds can be a reliable way to grow your money over time and achieve your financial goals.

There are different types of bonds to choose from, including government bonds, corporate bonds, and municipal bonds. Each type of bond has its own set of risks and rewards, so it’s important to do your research and understand the potential risks before investing.

When investing in bonds, you can also consider investing in bond funds. Bond funds are mutual funds that pool money from multiple investors to invest in a diversified portfolio of bonds. This can be a convenient way to invest in bonds without having to manage individual bond holdings.

Whether you’re a beginner investor or an experienced one, understanding bonds is essential for effective money management and achieving your ambitions. Take the time to learn about the different types of bonds and how they can fit into your overall investment strategy. With the right knowledge and strategy, you can make informed investment decisions and work towards your financial goals.

Building an Investment Portfolio

Are you looking to manage your money wisely and invest for your life’s ambitions? Discover the secrets to building an investment portfolio that will help you achieve your financial goals.

Investing can seem overwhelming, but with the right knowledge and guidance, you can make informed decisions that will grow your wealth and secure your future. Our experts will teach you how to diversify your investments, minimize risk, and maximize returns.

With our step-by-step approach, you will learn how to identify the best investment opportunities, whether it’s stocks, bonds, real estate, or other assets. We will show you how to analyze market trends, evaluate companies, and make strategic investment decisions.

Don’t let your money sit idle in a savings account. Start investing today and watch your wealth grow. Join our investment portfolio building program and take control of your financial future. With the right tools and knowledge, you can turn your ambitions into reality.

Tax Strategies

Looking for effective ways to manage your money and invest for your ambitions? Discover the power of tax strategies. By understanding and implementing smart tax strategies, you can maximize your funds and make the most out of your investments.

With the right tax strategies in place, you can minimize your tax liability and keep more money in your pocket. Whether you’re a business owner, an investor, or an individual looking to grow your wealth, tax strategies can help you navigate the complex world of taxes and make informed financial decisions.

By working with a team of tax professionals, you can develop a customized tax strategy that aligns with your ambitions and financial goals. They can help you identify deductions, credits, and other tax-saving opportunities that you may not be aware of.

From retirement planning to estate planning, tax strategies can play a crucial role in managing your money and achieving your long-term ambitions. Don’t let taxes hinder your financial growth. Take control of your finances today and unlock the secrets to effective money management and investing with tax strategies.

Evaluating Investment Opportunities

When it comes to achieving your ambitions and securing your financial future, it is crucial to invest your money wisely. Evaluating investment opportunities is a key step in managing your money effectively and maximizing your returns.

By carefully analyzing different investment options, you can discover the best ways to grow your funds and achieve your long-term goals. Whether you are considering stocks, bonds, real estate, or mutual funds, evaluating the potential risks and rewards is essential for making informed investment decisions.

One important aspect of evaluating investment opportunities is understanding the market trends and economic indicators that can impact your investments. This requires staying up-to-date with financial news, analyzing historical data, and consulting with knowledgeable professionals.

Another crucial factor to consider is diversification. By spreading your investments across different asset classes and sectors, you can minimize the risks and maximize the potential returns. Diversification helps protect your portfolio from the fluctuations of any single investment and allows you to take advantage of various growth opportunities.

Additionally, evaluating investment opportunities involves assessing the management teams and their track records. Understanding the expertise, experience, and performance of the fund managers or company executives can provide insights into the potential success of the investment.

In conclusion, evaluating investment opportunities is a vital step in effectively managing your money and achieving your ambitions. By carefully analyzing different options, understanding market trends, diversifying your portfolio, and assessing management teams, you can make informed decisions to grow your funds and secure your financial future.

Putting It All Together

When it comes to achieving your life’s ambitions, money plays a crucial role. It’s not just about earning a paycheck, but also about making smart financial decisions that will help you reach your goals. One of the most effective ways to do this is by investing your money wisely. By putting your money into a well-managed investment fund, you can grow your wealth and increase your chances of achieving your dreams.

Investing can seem daunting at first, but with the right knowledge and guidance, it can be a rewarding experience. It’s important to educate yourself about different investment options and strategies so that you can make informed decisions. Whether you’re interested in stocks, bonds, real estate, or other investment vehicles, there are plenty of opportunities to discover and explore.

By investing in a diversified portfolio, you can spread your risk and increase your chances of success. This means putting your money into a mix of different assets, such as stocks, bonds, and real estate. By diversifying, you can potentially reduce the impact of any one investment performing poorly, while also benefiting from the growth of other investments.

It’s also important to regularly review and adjust your investment strategy as your goals and circumstances change. Life is full of unexpected twists and turns, and your financial plan should be flexible enough to adapt. By staying informed and proactive, you can ensure that your money is working hard for you and helping you achieve your life’s ambitions.

FAQ:

What is “Unlocking the Secrets to Effective Money Management and Investing for Life’s Ambitions” about?

“Unlocking the Secrets to Effective Money Management and Investing for Life’s Ambitions” is a comprehensive guide that provides strategies and techniques for managing money effectively and making smart investment decisions. It covers various aspects of personal finance, including budgeting, saving, debt management, and investing for long-term goals.

Who is the author of “Unlocking the Secrets to Effective Money Management and Investing for Life’s Ambitions”?

The author of “Unlocking the Secrets to Effective Money Management and Investing for Life’s Ambitions” is John Smith, a renowned financial expert with years of experience in the field. He has helped numerous individuals and families achieve their financial goals through his practical advice and insights.

Is “Unlocking the Secrets to Effective Money Management and Investing for Life’s Ambitions” suitable for beginners?

Yes, “Unlocking the Secrets to Effective Money Management and Investing for Life’s Ambitions” is suitable for beginners. The book starts with the basics of personal finance and gradually progresses to more advanced topics. It is written in an easy-to-understand language, making it accessible to individuals who are new to money management and investing.

What are some of the topics covered in “Unlocking the Secrets to Effective Money Management and Investing for Life’s Ambitions”?

“Unlocking the Secrets to Effective Money Management and Investing for Life’s Ambitions” covers a wide range of topics, including creating a budget, setting financial goals, managing debt, understanding different investment options, building an emergency fund, and planning for retirement. It also provides tips for avoiding common financial mistakes and strategies for achieving long-term financial success.

Can “Unlocking the Secrets to Effective Money Management and Investing for Life’s Ambitions” help me achieve my financial goals?

Yes, “Unlocking the Secrets to Effective Money Management and Investing for Life’s Ambitions” can definitely help you achieve your financial goals. The book provides practical advice and proven strategies for managing money effectively and making smart investment decisions. By following the principles outlined in the book, you can develop a strong financial foundation and work towards your life’s ambitions.