- Discover the Retirement Hack: CPF Special Account (SA) Shielding and How It Can Benefit You

- What is CPF Special Account (SA) Shielding?

- Why is CPF Special Account (SA) Shielding important?

- Benefits of CPF Special Account (SA) Shielding

- Increased retirement savings

- Protection against financial emergencies

- Flexibility in using CPF savings

- How to Perform CPF Special Account (SA) Shielding

- Understand the CPF rules and regulations

- Set a target amount for CPF Special Account (SA) shielding

- Evaluate your financial situation

- Determine the best CPF investment options

- Monitor and adjust your CPF Special Account (SA) shielding strategy

- Common Mistakes to Avoid

- Not understanding CPF rules and regulations

- Setting unrealistic target amounts

- Neglecting to evaluate your financial situation regularly

- FAQ:

- What is CPF Special Account (SA) Shielding?

- How does CPF Special Account (SA) Shielding work?

Discover the Retirement Hack: CPF Special Account (SA) Shielding and How It Can Benefit You

Are you ready to unlock the secrets of maximizing your CPF retirement account? Introducing CPF Special Account (SA) Shielding – the ultimate cheat code for a secure and prosperous retirement.

Retirement can be a daunting prospect, but with SA Shielding, you can level up your savings game and ensure a comfortable future. By strategically allocating funds to your CPF SA, you gain access to a powerful tool that can shield your retirement nest egg from market volatility and inflation.

With SA Shielding, you can supercharge your CPF account and take advantage of the special benefits it offers. The CPF SA is designed to provide a higher interest rate than other accounts, making it an ideal choice for long-term retirement planning. By maximizing your CPF SA, you can harness the power of compounding interest and watch your savings grow exponentially.

But that’s not all – SA Shielding also offers added protection for your retirement funds. By shielding your CPF SA from withdrawals, you can safeguard your savings from impulsive spending or unforeseen emergencies. This means your retirement funds remain intact and continue to grow, ensuring a worry-free future.

Don’t miss out on this retirement cheat code – start mastering CPF SA Shielding today. Take control of your financial future and unlock the secrets to a secure and prosperous retirement. Your dream retirement is just a few strategic moves away!

What is CPF Special Account (SA) Shielding?

CPF Special Account (SA) Shielding is a financial strategy that allows individuals to perform a retirement ‘cheat code’ by maximizing the growth of their CPF Special Account. CPF, or Central Provident Fund, is a mandatory savings scheme in Singapore that aims to provide retirement, healthcare, and housing benefits to its citizens.

The CPF Special Account (SA) is one of the three CPF accounts and is specifically designed for retirement savings. By shielding the CPF SA, individuals can take advantage of the higher interest rates offered by the CPF Board, which can help grow their retirement savings faster.

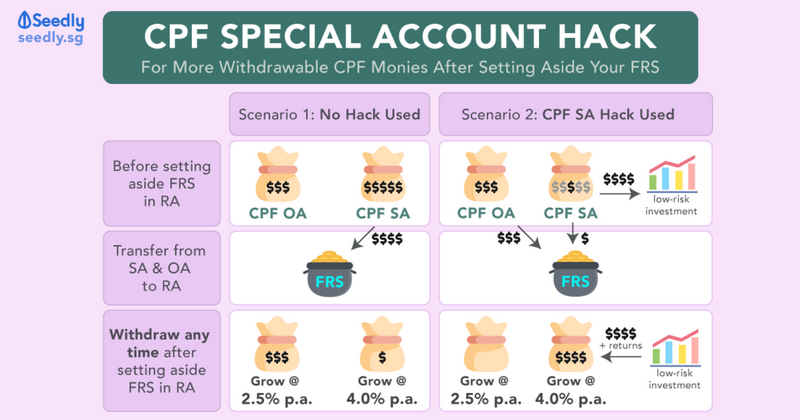

When performing CPF SA shielding, individuals transfer excess funds from their CPF Ordinary Account (OA) to their CPF SA. This allows them to earn a higher interest rate on the transferred amount, as the CPF SA offers a higher interest rate compared to the CPF OA.

By maximizing the growth of their CPF SA through shielding, individuals can potentially increase their retirement savings significantly over time. It is important to note that CPF SA shielding is a financial strategy that requires careful planning and consideration of one’s financial goals and circumstances.

If you are interested in exploring CPF SA shielding as a retirement strategy, it is advisable to consult a financial advisor or CPF specialist who can provide personalized advice based on your specific needs and goals.

Why is CPF Special Account (SA) Shielding important?

CPF Special Account (SA) Shielding is a retirement cheat code that can help you maximize your CPF savings and secure a comfortable retirement. By performing SA shielding, you can protect a portion of your CPF savings in your SA from being used for housing or education expenses, ensuring that it remains untouched for your retirement needs.

Shielding your CPF SA is essential because it allows you to take advantage of the higher interest rates offered by the CPF Board. The SA currently earns an attractive interest rate of up to 4% per annum, which is higher than the interest rates offered by most banks. By shielding your SA, you can ensure that your retirement funds grow at a faster rate, providing you with a larger nest egg when you retire.

Performing SA shielding is a straightforward process. You can do it online through the CPF website or by visiting a CPF service center. Simply fill out the necessary forms and indicate the amount of money you wish to shield in your SA. Once the shielding is approved, the designated amount will be protected and can only be used for retirement-related expenses.

By utilizing this retirement cheat code, you can have peace of mind knowing that a portion of your CPF savings is safeguarded for your golden years. Start shielding your CPF SA today and secure a comfortable retirement!

Benefits of CPF Special Account (SA) Shielding

CPF Special Account (SA) Shielding is a retirement cheat code that allows individuals to optimize their CPF savings for a better retirement. By performing SA shielding, individuals can strategically allocate their CPF funds to maximize their returns and ensure a secure financial future.

One of the key benefits of CPF SA shielding is the ability to earn higher interest rates on your retirement savings. By shielding your SA, you can enjoy an additional 1% interest on the first $60,000 of your combined CPF balances, which includes your Ordinary Account (OA) and SA. This means that you can potentially earn a higher return on your savings, helping you to grow your retirement nest egg faster.

Another advantage of SA shielding is the flexibility it offers in managing your CPF funds. By strategically allocating your savings between your OA and SA, you can have more control over how your CPF funds are used. This can be particularly beneficial if you have specific financial goals or plans for your retirement, such as funding your children’s education or buying a home.

SA shielding also provides a level of protection for your retirement savings. By segregating your SA from your OA, you can ensure that your CPF funds designated for retirement are not inadvertently used for other purposes. This can help to safeguard your financial security and ensure that you have sufficient funds for your retirement needs.

In summary, CPF SA shielding offers a range of benefits for individuals looking to optimize their retirement savings. From earning higher interest rates to gaining greater control over your CPF funds, SA shielding allows you to strategically manage your retirement savings for a secure and comfortable future.

Increased retirement savings

Are you looking for a way to boost your retirement savings? Look no further than CPF Special Account (SA) shielding. By performing this retirement cheat code, you can maximize the growth of your CPF SA account and ensure a comfortable retirement.

CPF SA shielding involves strategically allocating funds from your CPF Ordinary Account (OA) to your CPF SA. This allows you to take advantage of the higher interest rates offered by the SA, which can significantly increase your retirement savings over time.

By shielding your CPF SA, you can benefit from the power of compounding. The higher interest rates combined with the longer time horizon until retirement can result in substantial growth of your savings. This means more financial security and peace of mind during your golden years.

Don’t miss out on the opportunity to perform this retirement cheat code. Start shielding your CPF SA today and watch your retirement savings grow. Consult with a financial advisor or CPF expert to learn more about the process and how it can benefit your individual retirement goals.

Protection against financial emergencies

Are you worried about unexpected financial emergencies that could derail your retirement plans? CPF Special Account (SA) Shielding is the cheat code you need to perform to protect yourself.

By shielding your CPF SA, you can ensure that your hard-earned money is safe and secure, even in the face of unexpected financial challenges. With this special account, you have a shield against potential financial pitfalls.

When you perform the SA shielding code, you are taking proactive steps to safeguard your retirement savings. This code acts as a protective barrier, preventing any unauthorized access or withdrawal from your CPF SA.

With the SA shielding code in place, you can have peace of mind knowing that your funds are protected and can only be used for their intended purpose – to support your retirement. This cheat code gives you control over your financial future, allowing you to navigate any unexpected emergencies with confidence.

Don’t let financial emergencies catch you off guard. Take control of your retirement savings with CPF SA shielding and ensure that you have the necessary protection in place.

Flexibility in using CPF savings

Retirement planning can be a complex and daunting task, but with CPF Special Account (SA) shielding, you can unlock a retirement cheat code that offers flexibility in using your CPF savings. SA shielding allows you to protect your SA funds from being used for housing and medical expenses, giving you more control over your retirement savings.

By performing SA shielding, you can ensure that your CPF savings in the SA remain untouched, allowing it to grow over time and provide you with a larger nest egg for your retirement. This retirement cheat code enables you to have a separate pool of funds that can be used for other purposes, such as investments or funding your children’s education.

Performing SA shielding is a simple process that involves transferring a portion of your CPF savings from the SA to the Ordinary Account (OA). This transfer ensures that the funds in your SA are protected and can only be used for retirement-related expenses. By doing so, you can maximize the benefits of your CPF savings and have more flexibility in planning for your retirement.

Take advantage of this retirement cheat code and perform SA shielding to unlock the full potential of your CPF savings. With the flexibility it offers, you can have peace of mind knowing that your retirement funds are protected and can be used in a way that suits your needs and goals.

How to Perform CPF Special Account (SA) Shielding

Are you looking for a retirement cheat code? Look no further than CPF Special Account (SA) shielding. By performing this strategic move, you can maximize your retirement savings and enjoy a comfortable future.

CPF, or Central Provident Fund, is a special savings scheme in Singapore that helps individuals build a nest egg for retirement. The Special Account (SA) is a component of CPF that earns a higher interest rate and is designed for long-term savings.

Performing CPF SA shielding involves transferring funds from other CPF accounts to your SA. This allows you to take advantage of the higher interest rate and grow your retirement savings faster. By shielding your SA, you can ensure that your funds are protected and working harder for you.

With CPF SA shielding, you can unlock the retirement cheat code and secure a brighter financial future. Start by reviewing your CPF accounts and considering the amount you want to transfer to your SA. Consult with a financial advisor to understand the potential benefits and impact on your overall retirement strategy.

Don’t miss out on this opportunity to perform CPF Special Account (SA) shielding. Take control of your retirement savings and enjoy the peace of mind that comes with knowing you’ve maximized your CPF benefits. Start today and unlock the cheat code for a comfortable retirement.

Understand the CPF rules and regulations

Retirement planning can be a complex and overwhelming process, especially when it comes to managing your CPF (Central Provident Fund) account. However, by understanding the CPF rules and regulations, you can navigate through the system and make informed decisions about your retirement savings.

One important aspect to be aware of is the CPF Special Account (SA) shielding. This retirement ‘cheat code’ allows you to perform a strategic move to maximize your savings. By transferring funds from your Ordinary Account (OA) to your SA, you can shield a portion of your CPF savings from being used for housing or other purposes, ensuring that it remains untouched for your retirement.

To perform this SA shielding, you need to be familiar with the CPF rules and regulations. It is essential to know the limits and restrictions, as well as the benefits and implications of such a move. By understanding the CPF rules, you can make the most of your retirement savings and secure a comfortable future.

Additionally, staying updated on any changes or updates to the CPF rules is crucial. The government regularly reviews and adjusts the CPF system to ensure its sustainability and adequacy. By keeping yourself informed, you can adapt your retirement planning strategies accordingly and take advantage of any new opportunities that arise.

In conclusion, understanding the CPF rules and regulations is vital for anyone planning for retirement. By familiarizing yourself with the intricacies of the CPF system, including the SA shielding option, you can make informed decisions and maximize your savings for a secure and comfortable retirement.

Set a target amount for CPF Special Account (SA) shielding

Are you looking for a retirement cheat code? Look no further than CPF Special Account (SA) shielding. By performing this code, you can boost your retirement savings and secure a comfortable future.

To perform CPF Special Account (SA) shielding, you need to set a target amount for your account. This will serve as your goal and motivate you to save more. Determine how much you want to shield in your SA and calculate the contributions needed to reach that amount.

By setting a target amount, you have a clear objective to work towards. It allows you to track your progress and make adjustments if necessary. Plus, it gives you a sense of purpose and direction in your retirement planning.

Remember, CPF Special Account (SA) shielding is not a magic trick. It requires discipline and commitment to consistently contribute to your account. But with a target amount in mind, you have a tangible goal to strive for, making the journey more rewarding.

Start today and set a target amount for CPF Special Account (SA) shielding. Your future self will thank you for taking this retirement cheat code seriously and securing a comfortable retirement.

Evaluate your financial situation

When it comes to retirement planning, it’s important to evaluate your financial situation. One strategy that can help you maximize your retirement savings is shielding your CPF Special Account (SA). By understanding how this retirement cheat code works, you can perform it to your advantage.

The CPF Special Account (SA) is a special savings account in Singapore that is designed to provide for your retirement needs. By shielding your SA, you can ensure that your retirement funds are protected and grow over time.

To perform this cheat code, you need to assess your current financial situation. Take a look at your income, expenses, and savings. Determine how much you can afford to contribute to your SA and how much you need for other financial goals.

Consider your retirement goals and the lifestyle you want to maintain during your golden years. Evaluate how much you will need to save in order to achieve these goals. This will help you determine the amount you should shield in your SA.

Once you have evaluated your financial situation, you can take the necessary steps to shield your CPF Special Account. This may involve making regular contributions to your SA, adjusting your budget to prioritize savings, and seeking professional financial advice.

Remember, shielding your SA is a retirement cheat code that can help you maximize your CPF savings. By evaluating your financial situation and taking the necessary steps, you can ensure a secure and comfortable retirement.

Determine the best CPF investment options

If you want to make the most of your CPF Special Account (SA), it’s important to understand the different investment options available to you. By shielding your SA from early withdrawals, you can effectively perform a retirement “cheat code” and maximize your savings.

One option to consider is investing in fixed deposits. This low-risk investment allows you to earn a guaranteed return on your CPF SA funds. With a fixed deposit, you can lock in your investment for a fixed period of time, typically ranging from 1 to 5 years, and enjoy a higher interest rate compared to a regular savings account.

Another option is to invest in Singapore Government Securities (SGS). These bonds are considered one of the safest investments available and offer a stable return over time. By investing in SGS, you can diversify your CPF SA portfolio and potentially earn higher returns compared to other investment options.

If you’re willing to take on more risk, you may also consider investing in stocks or mutual funds. By investing in the stock market, you have the potential to earn higher returns over the long term. However, it’s important to note that stock market investments come with higher volatility and risks, so it’s crucial to do thorough research and seek professional advice before diving in.

Ultimately, the best CPF investment option for you will depend on your risk tolerance, financial goals, and investment knowledge. It’s important to carefully evaluate each option and consider seeking advice from a financial advisor to make an informed decision. By determining the best CPF investment options for your specific situation, you can effectively shield your SA and secure a comfortable retirement.

Monitor and adjust your CPF Special Account (SA) shielding strategy

Are you planning for a comfortable retirement? Do you want to make the most out of your CPF Special Account (SA)? With the CPF SA shielding strategy, you can perform a retirement cheat code that allows you to maximize your savings and secure a better future.

The CPF Special Account (SA) is a dedicated account for your retirement funds. By shielding your SA, you can protect it from being used for other purposes, such as housing or education expenses. This ensures that your retirement savings remain intact and continue to grow over time.

Monitoring and adjusting your CPF SA shielding strategy is crucial to ensure that you are on track to meet your retirement goals. By regularly reviewing your account and making necessary adjustments, you can optimize your savings and make the most out of your CPF SA.

One way to monitor your CPF SA shielding strategy is by keeping track of your contributions and withdrawals. By understanding how much you are contributing and withdrawing from your SA, you can assess if you are on track to meet your retirement goals or if any adjustments need to be made.

Additionally, it is important to stay informed about any changes or updates to CPF policies and regulations. This can help you make informed decisions about your CPF SA shielding strategy and ensure that you are taking advantage of any opportunities or benefits that may arise.

Remember, your CPF SA is a valuable asset for your retirement. By monitoring and adjusting your CPF SA shielding strategy, you can ensure that you are maximizing your savings and securing a comfortable future.

Common Mistakes to Avoid

When it comes to CPF Special Account (SA) shielding, it’s important to be aware of certain common mistakes that people often make. By avoiding these pitfalls, you can ensure that you are maximizing your retirement savings and taking full advantage of this retirement cheat code.

One common mistake is failing to perform the CPF SA shielding properly. This involves transferring funds from your Ordinary Account (OA) to your SA to earn higher interest rates. However, it’s important to understand the rules and guidelines for performing this transfer correctly. Make sure you are familiar with the CPF website and seek professional advice if needed.

Another mistake to avoid is not taking advantage of CPF’s retirement schemes and incentives. CPF offers various schemes and incentives to help individuals build their retirement savings. By not actively participating in these programs, you may be missing out on opportunities to grow your CPF account and increase your retirement funds.

Additionally, it’s crucial to regularly review and monitor your CPF account to ensure that you are on track with your retirement goals. Failing to do so can result in missed opportunities or potential losses. Take the time to understand your CPF statement, track your contributions, and make adjustments as necessary.

Lastly, don’t underestimate the power of compounding interest. By starting early and consistently contributing to your CPF account, you can harness the power of compounding to grow your retirement savings significantly. Avoid the mistake of procrastinating or not prioritizing your CPF contributions.

In conclusion, by avoiding these common mistakes and being proactive in managing your CPF account, you can make the most of the CPF SA shielding retirement cheat code. Take the time to educate yourself, seek professional advice if needed, and stay proactive in growing your retirement funds.

Not understanding CPF rules and regulations

If you are planning for your retirement, it is crucial to understand the CPF rules and regulations. The CPF (Central Provident Fund) is a special account that is designed to help Singaporeans save for their retirement. However, many people are not aware of the various ways they can perform a “cheat code” to maximize their CPF savings.

One of the strategies that can be used is SA shielding. The Special Account (SA) is a component of the CPF account that earns a higher interest rate compared to the Ordinary Account (OA). By transferring funds from the OA to the SA, you can take advantage of the higher interest rate and grow your retirement savings faster.

SA shielding is a legal and effective way to boost your CPF savings. It involves transferring excess funds from the OA to the SA, which can be done by making a voluntary cash top-up or transferring funds from other sources such as your bank account or investments. By doing so, you can enjoy the benefits of the higher interest rate and potentially increase your retirement nest egg.

However, it is important to note that SA shielding should be done with careful consideration and understanding of the CPF rules and regulations. There are certain limitations and restrictions on the amount that can be transferred, as well as eligibility criteria that need to be met. Therefore, it is advisable to seek professional advice or consult with a CPF expert to ensure that you are making the right decisions for your retirement planning.

Setting unrealistic target amounts

When it comes to planning for retirement, it’s important to set realistic target amounts for your savings. However, many people fall into the trap of setting unrealistic goals that are difficult or impossible to achieve. This can lead to frustration and disappointment down the road.

One way to avoid this is by using the CPF Special Account (SA) Shielding cheat code. By performing this cheat code, you can protect your SA account from being used for other purposes, ensuring that you have a dedicated pool of funds for your retirement.

With the CPF SA Shielding cheat code, you can rest easy knowing that your retirement savings are secure and not at risk of being depleted for other expenses. This cheat code is a powerful tool that can help you stay on track towards your retirement goals.

Don’t fall into the trap of setting unrealistic target amounts for your retirement savings. Instead, take advantage of the CPF Special Account (SA) Shielding cheat code to ensure that you have a dedicated pool of funds for your golden years. Start performing this cheat code today and take control of your retirement savings.

Neglecting to evaluate your financial situation regularly

One common mistake people make when it comes to managing their finances is neglecting to regularly evaluate their financial situation. This can have serious consequences, especially when it comes to retirement planning. Without regularly reviewing your accounts and making adjustments as needed, you may be missing out on opportunities to optimize your retirement savings.

One key account to pay attention to is your CPF Special Account (SA). This account is specifically designed for retirement savings, and by performing regular evaluations, you can ensure that you are maximizing its potential. By understanding how to navigate the CPF SA system, you can effectively use it as a retirement ‘cheat code’ to boost your savings.

Performing regular evaluations of your CPF SA allows you to assess whether you are on track to meet your retirement goals. By reviewing your contributions, interest rates, and investment options, you can make informed decisions about how to best allocate your funds. This can help you take advantage of any available incentives or strategies that can further enhance your retirement savings.

Don’t underestimate the power of regularly evaluating your financial situation, especially when it comes to retirement planning. By taking the time to assess your CPF SA and make necessary adjustments, you can ensure that you are making the most of this retirement ‘cheat code’ and setting yourself up for a secure financial future.

FAQ:

What is CPF Special Account (SA) Shielding?

CPF Special Account (SA) Shielding is a retirement strategy that allows you to maximize your CPF Special Account (SA) savings by transferring excess funds from your Ordinary Account (OA) to your SA. This helps to boost your SA balance and potentially increase your retirement income.

How does CPF Special Account (SA) Shielding work?

CPF Special Account (SA) Shielding works by transferring excess funds from your CPF Ordinary Account (OA) to your CPF Special Account (SA). This can be done through a voluntary contribution or by making a cash top-up to your SA. By doing so, you can increase your SA balance, which earns a higher interest rate compared to the OA, and potentially increase your retirement income.